HIGHLIGHTS

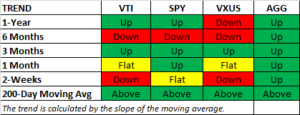

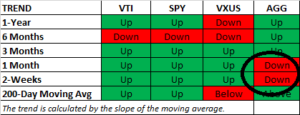

- US stocks get slammed on Friday and fall by 1% for the week.

- The 3m/10yr yield curve inverts for the first time since 2007.

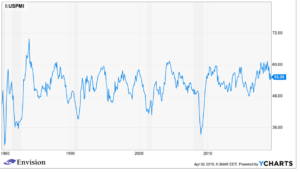

- Weak manufacturing reports in Europe and the US.

- Slow growth in US service sector.

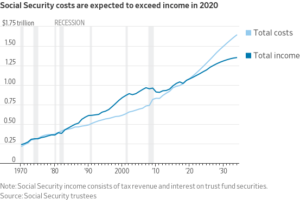

- The budget deficit keeps expanding at frightening rates.

- Brexit is delayed temporarily.

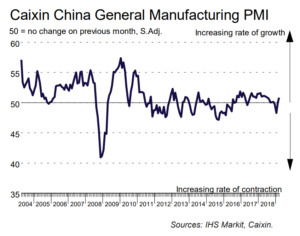

- Trump may keep tariffs in place with China.

MARKET RECAP

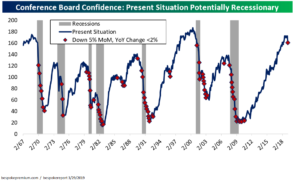

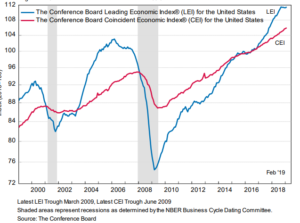

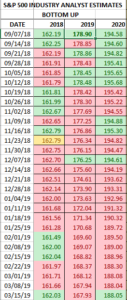

What has become a tug of war between the bulls and the bears went to the bear side this week as US equities fell by 1%. A fast-moving decline in interest rates got going on Wednesday after the Fed meeting (see below) and then accelerated to the downside on Friday. That inverted the yield curve (3m/10yr) and raised recession fears. The economy has been going one way (down) while stocks have been going the other way (up) and that divergence will have to be resolved one way or the other. Hence, the tug of war. The inverted yield curve, along with a negative report on Friday that showed that factory output in the Eurozone fell at the fastest rate in almost six years, and that a gauge of US manufacturing activity dropped to its lowest level in two years, was enough for US stocks to fall 2.1% on Friday and turn what would have been an up week into a losing week.

FED / INTEREST RATES

Fed Chairman Jerome Powell made it clear that the Fed would most likely not raise interest rates this year. On Wednesday, Powell said, “It may be some time before the outlook for jobs and inflation calls clearly for a change in policy.” This is a complete reversal from as recently as December when the Fed had planned on multiple interest rate increases.

With no interest rate increases insight and a weakening economy, the yield on the 10-year bond fell by 15 basis points during the week. Yields on the German and Japanese 10-year note fell below zero percent.

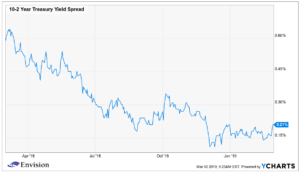

The spread between the 3-month treasury bill and the 10-year bond inverted for the first time since 2007. This is a highly watched indicator that has preceded every US recession since 1975. On the other hand, the indicator has inverted at times without a subsequent recession in the near-term. Also, rates on high-yield bonds have not increased. St, Louis Fed President James Bullard said that the inversion was “mildly concerning”, hoping that the inversion was temporary. A sustained inversion would worry him much more.

As interest rates have been falling, so have mortgage rates, and that helped push sales up of previously owned homes by 11.8% in February, the largest gain since 2015 and the second biggest increase ever. However, high prices and a shortage of starter-homes remain impediments to the housing industry.

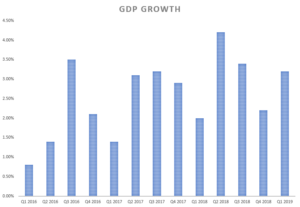

The Fed is still positive on the economy, although they did revise growth estimates downward. The central bank projects US GDP will expand 2.1% this year and 1.9% in 2020. Powell said the Fed has “a positive outlook for this year” helped by rising wages, low unemployment, and high consumer confidence. Powell did highlight risks including slowing growth in Europe and China and US trade policy.

SERVICES

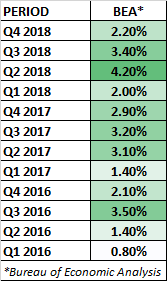

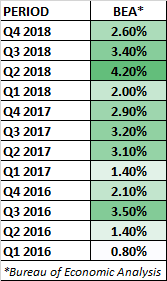

The Census Bureau said on Thursday that revenues across the U.S. service sector rose by 1.2% in Q4. That was the slowest growth in five quarters and lower than expected. Economists are now projecting that the first estimate for Q4 growth of 2.6% will be revised downward. The slower than expected service revenue report follows lower numbers on construction spending. JP Morgan is estimating Q4 growth at 1.8%, Macroeconomic Advisers is at 2%, and Oxford Economics projects 1.9%.

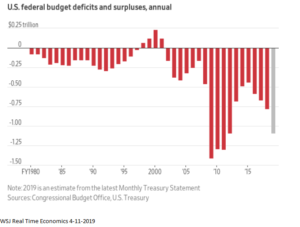

BUDGET DEFICIT

The budget deficit just continues to get worse and worse. The gap widened by 39% for the first five months of the year as revenues remained roughly level and federal spending increased. The deficit was $544 billion from October through February, compared to $391 billion last year. Federal revenues declined by less than 1% but federal outlays increased by 9%. There were some timing differences, and taking those into account, the deficit would have expanded by 25%, still a dramatic number. Healthcare, the military, and tariff assistance programs for farmers were contributors to the increase in spending.

BREXIT

EU leaders said they would extend the Brexit deadline until May 22 if the British Parliament approves the agreement next week. If the agreement is not approved, the UK would have until April 12 to indicate how they plan to move forward. Under that scenario, the UK could ask for a longer extension, or there can be a hard Brexit in mid-April.

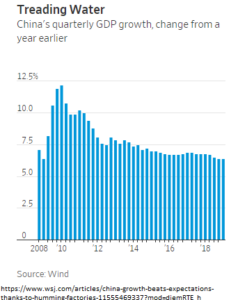

CHINA

Trump said that he might keep tariffs in place with China for a “substantial period of time” even if the US and China agree to a deal.

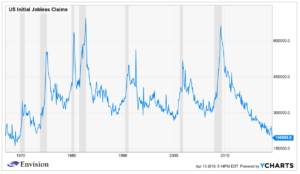

JOBLESS CLAIMS

In good news, initial jobless claims fell by 9,000 to 221,000, below the estimate of 225,000.

SCOREBOARD

Past performance does not guarantee future results.

The purpose of this commentary is to provide readers with a summary of recent market and economic news. It is not intended to provide trading or investing advice. Investors should have a long-term plan and should consider working with a professional investment advisor. Any discussion of investments and investment strategies represents the presenter’s views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. The information and opinions contained in this material are derived from sources believed to be reliable, but they are not necessarily all-inclusive and are not guaranteed as to accuracy. Any forecasts may not prove to be correct. Economic predictions are based on estimates and are subject to change. Reliance upon information in this material is at the sole discretion of the reader.