HIGHLIGHTS

- Stocks were up but the Dow ended its nine-week winning streak.

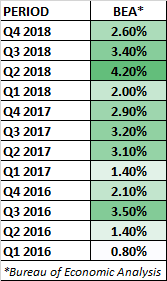

- Q4 GDP comes in better than expected at 2.60% but Q1 is looking bleak.

- Interest rates increased during the week.

MARKET RECAP

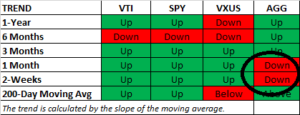

US stocks were up by 0.45%, although the Dow Jones Industrial Average ended its nine-week winning streak, falling by 0.02%. International stocks managed a gain of 0.17%. Bonds fell by 0.47% as interest rates increased across the curve. For January and February, it was the best opening two months of a year since 1991. The S&P 500 was up by 12.07%.

GDP

The US economy grew by 2.6% in Q4, adjusting for seasonal activity. That was higher than the consensus estimate of 2.2%. Output was up 3.1% year over year, making it two quarters in a row of greater than 3% year over year growth. The White House thinks 3% growth will continue. The Federal Reserve estimates growth of 2.3% in 2019, 2.0% in 2020 and 1.8% in 2021. For the year of 2018, the economy grew by 2.9%.

The initial estimates for Q1 look weak. The Atlanta Fed’s GDPNow model has Q1 growth at 0.30% and the NY Fed’s Nowcast model is at 0.88%. Over recent quarters, the GDPNow model has trended lower as the quarter has progressed, so starting at 0.30% is not a good sign.

INTEREST RATES

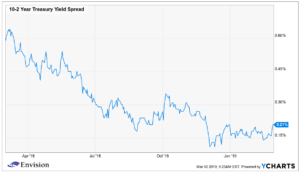

The better than forecasted GDP numbers increased interest rates during the week. That, along with a Fed that has made it clear that it will be patient before increasing interest rates again might be increasing inflation expectations, resulting in higher rates. Rates on the 2-year increased by 7 basis points and on the 30-year by 11 basis points. The spread between the 10 and 2-year treasury bonds has increased to 21 basis points, the highest amount since December. That would be a positive, as the threat of a 10-year bond yielding less than a 2-year bond (an inverted yield curve) is considered a recessionary signal.

The increase in interest rates was enough to change the price trend to negative (as interest rates go up, bond prices go down) on the AGG (the aggregate bond index) for the 2-week and one-month period for the first time since November 16, 2018.

Increased talk by Democratic presidential candidates about using Modern Monetary Theory as justification for vastly widening deficits might be seeping into the pricing of interest rates. As we have written and spoken about many times, neither political party has a serious interest in getting deficits under control and now there is open talk of expanding them even more.

YELLEN ON TRUMP

Former Fed Chair Janet Yellen was asked this week if she thinks that President Trump has a grasp of economic policy, she responded, “Well, I doubt that he would even be able to say that the Fed’s goals are maximum employment and price stability, which is the goals that Congress have assigned to the Fed. He’s made comments about the Fed having an exchange rate objective in order to support his trade plans, or possibly targeting the U.S. balance of trade. And, you know, I think comments like that shows a lack of understanding of the impact of the Fed on the economy, and appropriate policy goals.”

SCOREBOARD

Past performance does not guarantee future results.

The purpose of this commentary is to provide readers with a summary of recent market and economic news. It is not intended to provide trading advice. Investors should have a long-term plan and should consider working with a professional investment advisor. Any discussion of investments and investment strategies represents the presenter’s views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. The information and opinions contained in this material are derived from sources believed to be reliable, but they are not necessarily all inclusive and are not guaranteed as to accuracy. Any forecasts may not prove to be correct. Economic predictions are based on estimates and are subject to change. Reliance upon information in this material is at the sole discretion of the reader.