MARKET RECAP

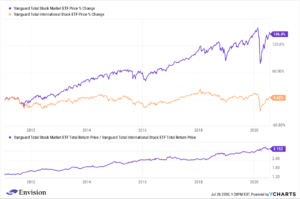

US equities were up by 1.74% while international stocks fell by 0.78%. Second-quarter GDP fell by a seasonally adjusted 32.9%. It was the biggest drop since World War II when the government started to record the numbers. The number reflects an annualized rate and assumes that the huge decline in output will continue for the year, which will likely not happen. Nevertheless, it shows just how huge a hit the economy took by essentially shutting down for a couple of months. And that was with massive stimulus. Joseph Carson, the former chief economist for AllianceBernstein, estimates that the Federal Reserve and the US government put close to $5 trillion dollars into the economy, roughly matching the nominal GDP of $4.85 trillion. But even with that, GDP fell dramatically. Clearly showing how important a normally functioning economy, with healthy businesses, is to the success of the country. But the 33% decline in the US appears to be better than what happened in Europe, preliminary GDP numbers show Germany with a 35% decline and the other Eurozone majors each declining by more than 40%.

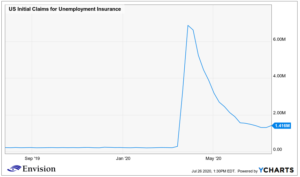

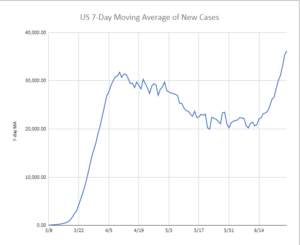

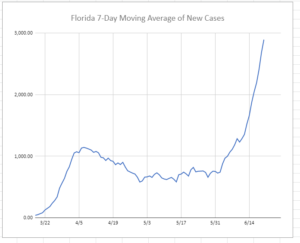

The unemployment numbers are showing that the spike in Covid cases is starting to slow the economy again. The number of initial claims for unemployment increased for the second straight week, up by 12,000 to 1.43 million, and the number of people receiving unemployment increased by 867,000 to $17 million, that increase ended a downward trend that had started in March.

Kodak, which most people probably thought went out of business 10 or more years ago, is still around and popped up on traders’ radar this week. The company filed for bankruptcy in 2012 and has had negative cash flow every year since. The company was selling for $2 per share on Wednesday when it announced that the federal government would loan them $765 million for the manufacture of generic drug ingredients. The Robin Hood investors jumped on it and the stock popped to as high as $60 on Thursday. Another example of the frothiness in this market.

SCOREBOARD