MARKET RECAP

Stocks rallied by about 2% in the US and 0.88% outside the US. An improving US economy, from a historically low base, is helping markets. Added stimulus from central banks in the last few weeks is also providing lots of help. And then there is the fear of missing out, with a rally that does not seem to want to stop, investors who missed out are tempted to pile in.

Retail sales were up by 17.7% in May, a record increase. That follows the largest monthly drop ever, 14.7%, in April. However, spending is still lower than the pre-pandemic levels.

The Fed said on Monday that it has $250 billion ready to buy corporate bonds. The central bank said it would begin making those purchases this past Tuesday. The bonds would consist of a broad index that meets certain criteria.

Jobless claims seem to be leveling off. 1.5 million applied for benefits last week, down by 58,000. And the number of Americans receiving benefits fell by 62,000 to 20.5 million in the week ending June 6.

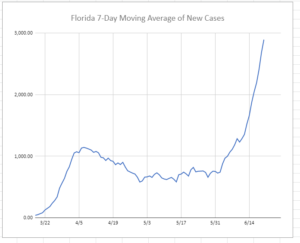

Not all the news is good, markets were spooked on Friday when Apple said they would temporarily close 11 stores in states where the virus is spiking. Case counts are starting to rise quickly in Florida, Texas, Arizona, and California. But these states seem intent on not closing. Meanwhile, in China, a flare-up in Covid cases led to a lock-down in Beijing. Chinese officials canceled flights in and out of the city, closed business, schools, and limited movement in an attempt to stop the next wave of cases.

Many Americans have stopped paying off loans. More than 100 million student loans, auto loans, and other debts have not been paid since the virus started, according to credit reporting firm TransUnion. About 80% of that number is for student loans.

SCOREBOARD