MARKET RECAP

The S&P 500 was up 1.1% for the week. On Thursday, the market had its biggest decline since June 18th, but the Friday rally put the market at another record close. Bond yields fell during the week. The 10-year treasury yield closed at 1.354% on Friday and got as low as 1.287% on Thursday, that was down from 1.434% last week.

Individual investors are “all-in” when it comes to investing in the stock market. According to Vanda Research, individual investors purchased $28 billion of stocks in June, the most since 2014. Investors also opened more than 10 million new accounts so far this year, about equal to what was opened in all of 2020, according to JMP Securities. But the enthusiasm is not equally shared with professional investors, who are still positive on the market for the most part, but uneasy with high valuations, the threat of inflation, and an eventual pullback by the Fed. While this bull market seems to have broken all the rules, in the past, mass participation by individual investors has sometimes signaled market tops.

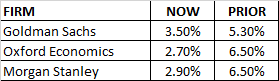

Treasury yields tumbled to multi-month lows as Fed minutes indicated the Fed was in no rush to stop purchasing bonds and the fast-spreading Delta variant might slow down, at least to some degree, the fast improving economy. Notes released from a Federal Reserve meeting showed that some Fed officials were not as confident about the economic outlook and therefore want to maintain its massive purchases of government bonds. And an Israeli study showed that while the variant does provide a good level of protection against the variant, it is more like 65% than 95%.

The Labor Department reported on Wednesday that at the end of May there was 9.2 million job openings, the most ever. There are currently 9.3 million Americans unemployed that are actively seeking work.

President Biden issued an executive order to increase competition in the economy targeting agriculture, technology, and drugs. Biden said that “The heart of American capitalism is a simple idea: open and fair competition.” We actually agree with many parts of the Biden initiatives, over the last 30 years or so it has become harder and harder to start and grow a small business in the United States, hurting aspiring entrepreneurs, prospective employees, and consumers.

SCOREBOARD