TRUMP’S SPEECH

In many ways, this was the speech we have been waiting for. Trump leaned towards the optimistic side, gave a speech without insults and attacks, a speech that tried to bring the country together, instead of apart. Other than his short victory speech at 3 am the night of the election, it was the first time Trump actually acted sounded presidential, and because of that, his message was much more effective.

Trump proposed a $1 trillion infrastructure package, replacing Obamacare, lowering drug costs, lower tax rates and free and fair trade.

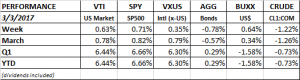

The market liked what it heard and the way it was said, and the Dow jumped 300 points the next day. For the week, US equities were up 0.63%. International stocks advanced 0.35%.

Interest rates, which had been falling recently, turned around and jumped about 20 basis points. That pushed the prices of the bond index down by 0.78%.

Unfortunately, by week’s end Trump was back to his old self. Declaring on Saturday morning, via Twitter, that Obama had tapped his phones, without presenting a shred of evidence. One has to wonder how long the markets can ignore the President’s bizarre behavior

GDP

For all the forward-looking optimism on the markets, the story is not so bright in real-time, at least according the the Atlanta Fed’s GDPNow model. Q1 growth fell to 1.8% from 2.40% on a lower forecast for personal consumption expenditures. The estimate from the NY Fed’s Nowcast was not as dreary, remaining steady at 3.10%. Lower than expected inventories for manufacturers and merchant wholesalers offset the negative news on personal consumption expenditures in their model.

But around the globe the economic outlook continues to look brighter. The global manufacturing PMI increase by 0.2 points to 52.9 in February. the index is now up six months in a row, that is the longest winning streak in three years and the index is at its highest level since May of 2011. 86% of individual countries are now in expansion territory.

FED

The Fed has been more aggressive in sending the message that a rate hike will happen sooner, rather than later. A March rate hike is now likely.

JOBLESS CLAIMS

Initial claims for unemployment dropped by 19k to 223k, the lowest amount since March of 1973. The four-week average now stands at 234,250 and that is the lowest number since April of 1973.