PERFORMANCE/HEALTHCARE/TAX REFORM

The Republicans could not put together sufficient support to pass the American Healthcare Act, thereby leaving Obamacare in place for the at least the near future. The uncertainty of the legislation passing and the possible negative implications for policy proposals that have energized the market since November, made for a rocky week, at least by recent standards. Equities dropped by over 1% on Tuesday, the first time in 160 days the market fell by more than 1%. For the week, US equities were down about 1.4%.

With the ACHA out of the way for the time being, tax reform becomes front and center. That, along with deregulation and repatriation are really tops on investor’s agenda and that is the fuel that has propelled a lot of this market rally. If the healthcare debacle foreshadows potential problems with Trump’s more business oriented proposals, the justification for a good portion of the recent really will come into question, thereby threatening values.

EARNINGS

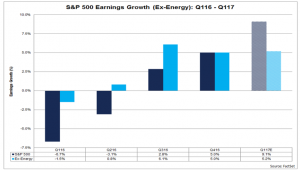

Higher expected earnings has also helped the rally. For Q1, the estimated earnings growth rate, according to FactSet, is a whopping 9.1%. If it happens, that would be the highest year over year increase since Q4 of 2011 when earnings jumped by 11.6%. Much of that increase will be due to the energy sector, where the average price of oil is 50% higher than a year ago. Excluding energy, earnings estimates are for a 5.2% advance.

ECONOMY

The Markit Flash US Services PMI fell 0.9 points to 52.9. That is the lowest level in six months. Service orders were the weakest in 12 months and new manufacturing orders were the weakest since last October.

New home rose 6.1% in February. The sales rate is now at its highest level since August of 2008 on a 12-month average basis, a positive sign for the housing market.

Initial claims for unemployment rose 15,000 to 258,000. Still at a historically low level but up from recent weeks.

The Atlanta Fed’s GDPNow model is forecasting growth of only 1% in Q1. This contrasts with the NY Fed’s Nowcast that currently forecast Q1 growth of 3.0%.