THE PROBLEM WITH OUT-OF-CONTROL DEBT

As we all know, this country has had terrible leadership regarding the deficit for decades. Still, incredibly, it has gotten successively worse as time passed, especially with Trump and then Biden. Neither has shown interest in keeping the country’s financial affairs in order. Clinton was the last President to have any success.

This year, US debt will approximate GDP, a marker that has never worked well for previous empires. The WSJ has outlined this in an article titled “Will Debt Sink the American Empire.”

Trump and Biden have added about $7 trillion each to the debt. Historian Niall Ferguson says, “Any great power that spends more on debt service than on defense will not stay great for very long.” That has turned out to be true for the Roman Empire, Spain, France, the Ottoman Empire, and the British Empire. This law will be tested by the U.S. beginning this very year.”

Interest payments on the debt now surpass defense spending and almost match Medicare spending. The record debt as a percent of US GDP was 106%, but that was just after World War II; the US is set to match that number by 2028; by 2034, it is projected to hit 122%.

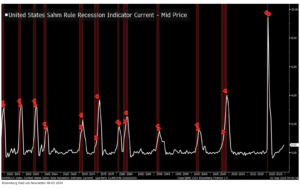

The CBO says the debt burden will lower income growth by 12% over the next few decades. We have, in effect, been borrowing from the future to grow the economy. Any recession, and unexpected event (like hurricanes or financing wars), Covid, its all no problem, just borrow some more, no need for any sacrifice, that has been the mindset.

The Roman Empire’s strategy was to debase the currency, which led to inflation and its eventual fall in the 5th century. Spain borrowed outside the country and and had high taxes, leading to its fall. Spain defaulted on debt 13 times over four centuries. France followed a similar path. China was a leading economic power in the 19th century, but out-of-control spending and borrowing led to underinvestment, and it couldn’t keep up with other countries. Britain’s debt crowded out other spending, the currency declined, and the country followed.

Treasury Secretary Yellen says that if debt can be held at current levels, “we’re in a reasonable place.” But who believes that will happen? A few examples of countries that pulled back from the brink include Canada, Denmark, Sweden, and Finland.

There will be ramifications whenever the country begins to deal with it. Of course, they will be much worse if we are forced to. Hopefully, the US can begin the process of dealing with this gargantuan problem now to minimize or at least reduce the impact.