MARKET RECAP

- US stocks were down by 2.52% for the week, international stocks by 2.72%, bonds had a monster rally, up by 2.36%.. The Russell 2000 was down by 6.7%. The Dow fell 600 points on Friday. The NASDAQ is now down just over 10% from its July 10th high and is in correction territory. The 10-year yield fell more this week than any time since March of 2020.

- There was a sharp slowdown in jobs in July, up by 114,000, falling short of the expectations of 170,000. The unemployment rate increased to 4.3%, a three-year high. Average hourly earnings were up by 3.6% yearly, the lowest gain since May of 2021.

- The VIX closed at its highest level of the year.

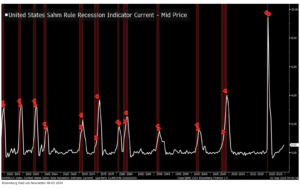

- The Sahm Rule was triggered, an early recessionary indicator.

- But hard economic data still points to more of a soft landing than a hard one. According to Torsten Slok, Chief Economist at Apollo, “There are no signs of a slowdown in restaurant bookings, TSA air travel data, tax withholdings, retail sales, hotel demand, bank lending, Broadway show attendance, and weekly box office grosses. Combined with GDP in the second quarter coming in at 2.8%, the bottom line is that the current state of the economy can be described as slowing, but still a soft landing.”

SCOREBOARD