SCOREBOARD

The Problem with Out-Of-Control Debt

THE PROBLEM WITH OUT-OF-CONTROL DEBT

As we all know, this country has had terrible leadership regarding the deficit for decades. Still, incredibly, it has gotten successively worse as time passed, especially with Trump and then Biden. Neither has shown interest in keeping the country’s financial affairs in order. Clinton was the last President to have any success.

This year, US debt will approximate GDP, a marker that has never worked well for previous empires. The WSJ has outlined this in an article titled “Will Debt Sink the American Empire.”

Trump and Biden have added about $7 trillion each to the debt. Historian Niall Ferguson says, “Any great power that spends more on debt service than on defense will not stay great for very long.” That has turned out to be true for the Roman Empire, Spain, France, the Ottoman Empire, and the British Empire. This law will be tested by the U.S. beginning this very year.”

Interest payments on the debt now surpass defense spending and almost match Medicare spending. The record debt as a percent of US GDP was 106%, but that was just after World War II; the US is set to match that number by 2028; by 2034, it is projected to hit 122%.

The CBO says the debt burden will lower income growth by 12% over the next few decades. We have, in effect, been borrowing from the future to grow the economy. Any recession, and unexpected event (like hurricanes or financing wars), Covid, its all no problem, just borrow some more, no need for any sacrifice, that has been the mindset.

The Roman Empire’s strategy was to debase the currency, which led to inflation and its eventual fall in the 5th century. Spain borrowed outside the country and and had high taxes, leading to its fall. Spain defaulted on debt 13 times over four centuries. France followed a similar path. China was a leading economic power in the 19th century, but out-of-control spending and borrowing led to underinvestment, and it couldn’t keep up with other countries. Britain’s debt crowded out other spending, the currency declined, and the country followed.

Treasury Secretary Yellen says that if debt can be held at current levels, “we’re in a reasonable place.” But who believes that will happen? A few examples of countries that pulled back from the brink include Canada, Denmark, Sweden, and Finland.

There will be ramifications whenever the country begins to deal with it. Of course, they will be much worse if we are forced to. Hopefully, the US can begin the process of dealing with this gargantuan problem now to minimize or at least reduce the impact.

Week Ending 6/7/2024

MARKET RECAP

- US stocks =0.17%, international +0.20%, bonds +0.05%.

- The ISM report for manufacturing dropped to 48.7 from 49.2 in April, the consensus was for 49.8.

- The number of job openings is at a three-year low of 8 million.

- Brent crude oil dropped to as low as $78.92 on Friday, the lowest price since February.

- India’s Modi lost seats in the election, and Claudia Sheinbaum was elected President of Mexico.

- The S&P 500 closed at a record on Wednesday, its 25th record close this year.

- 272,000 jobs were added in May, smashing the estimate of 180,000. The unemployment rate increased to 4%.

- The net worth of Americans increased by 3.1% or $5.1 trillion, in Q1.

- NVDA topped a $1 trillion valuation.

US STOCK MARKET as represented by the VTI

MARKET RECAP

Week Ending 5/24/2024

MARKET RECAP

- US stocks were flat for the week, although the Nasdaq managed a 1.4% advance, helped by blockbuster earnings by Nvdia. The Dow fell by 2.33%.

- The Dow had its worst day of the year on Thursday, falling 600 points, on inflation worries after solid numbers in a manufacturing survey. The index closed below the 40,000 mark at 39,069.

- Target fell 8% on Wednesday as sales declined for the fourth quarter, but TJ Maxx and Ross have had positive reports.

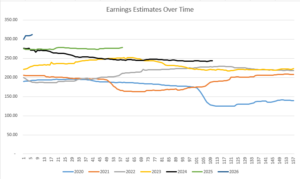

- Earnings estimates have been rising; the SPX is expected to show an 11% increase in 2024 and 14% in 2025.

NVIDIA

SCOREBOARD

Week Ending 5/17/2024

MARKET RECAP

- US stocks +1.65%, international +1.90%, bonds +0.55%.

- Indexes closed at records this week as the rally continued, as investors are hoping that interest rate cuts later in the year are back on the board, given that US inflation eased slightly from April’s pace and that the economy might be softening a bit.

- PPI numbers were higher than expected, but CPI numbers were lower.

- The Dow broke another milestone, closing just above 40,000. See the chart below.

DOW CLOSES ABOVE 40,000

SCOREBOARD

Week Ending 5/10/2024

MARKET RECAP

- US stocks +1.78%, international stocks +1.09%, bonds +0.23%.

- Stocks are back to within about 1% of highs while consumer confidence is falling. The University of Michigan consumer sentiment survey is at a six-month low.

- Earnings estimates have ramped up in the last few weeks; see the chart below.

- GDPNow estimates Q2 growth to be at a strong 4.20%.

- Talk of a recession seems to be receding on earnings calls. Meanwhile, the “10% recession rule” followed by Piper Sandler was triggered last week. The rule is triggered when the three-month moving average of people unemployed rises 10% compared with its level from the prior year.

- Social Security is forecast to run out of funds in 2033, and benefits will drop by 21%, assuming no fix.

EARNING ESTIMATES OVER TIME

SCOREBOARD

Week Ending 5/2/2024

Week Ending 4/26/2024

MARKET RECAP

- US stocks rally by 2.67%, international stocks +2.50%, bonds -0.05%.

- The first estimate for GDP for Q1 2024 came in at 1.6%, below the expectations of 2.4% and down from 3.4% in Q4.

- Google had a big week, up 11.59%,

- Core PCE was 2.8% year over year and up 0.3% for the month.

- The 10-year treasury closed the week yielding 4.67%, just off its 5-month high, hit earlier in the week, of 4.696%.

- The US has been outperforming the rest of the world economically, but we have been running deficits at twice the average in Europe. So much of the growth is due to this fiscal stimulus and out-of-control deficits that neither party has the guts to deal with. The US accounts for 26.3% of world GDP, the highest in 20 years.

- However, other factors that are probably helping are immigration, although mostly illegal, which still positively seeps into the economy, the growth in AI, and higher labor productivity. Labor productivity increased by 3.3% in Q4 of 2023.

US STOCK MARKET – 5 YEAR WEEKLY CHART OF VTI

SCOREBOARD

Week Ending 4/12/2024

MARKET RECAP

- US stocks -1.63%, international -2.03%, bonds -0.74%.

- Markets have been down for two straight weeks. Inflation continued to be higher than expected. Core services were up 5.4%. Consumer inflation expectations are rising, according to a University of Michigan survey.

- Investors expected six to seven rate cuts at the beginning of the year, but they are now down to one to two and maybe zero.

- The yield on the 10-year treasury is now 4.50% and is trending higher; see chart below.

- Bank stocks took a hit. JP Morgan has been on fire (in a good way) all year, fell by 6.5%, as high interest rates are beginning to cut into profits.

- The Philadelphia Fed reports that 3.5% of credit card balances are over 30 days past due, the highest delinquency rate since the data was recorded in 2012.

- International tensions are way up; investors were bracing for an Iranian attack on Israel, and it happened over the weekend. Israel did an exceptional job repelling the attacks.

CHART OF 10-YEAR TREASURY YIELD

SCOREBOARD

Week Ending 4/5/2024

MARKET RECAP

- US stocks -1.05%, international -0.48%, bonds -0.99%, bitcoin -3.1%.

- US payrolls increased by 303,000, much greater than the 200k estimate. Unemployment fell to 3.8%, wages rose, and the workforce participation rate increased.

- Fed official Neel Kashkari suggests that no rate cuts may be necessary in 2024, returning to the viewpoint we suggested two weeks ago.

- The ISM for manufacturing shows an expanding economy for the first time since the fall of 2022, up to 50.3 in March from 47.8 in February; economists expected 48.1.

- New factory orders were up 1.4% in March versus 1% in February.

SCOREBOARD