MARKET RECAP

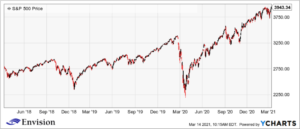

Stocks were flat for the week but the “Everything Up” market is still in command. Lumber, residential homes, stocks, bitcoin, dogecoin, Gamestop, SPACs, etc, if not at an all-time high, these assets were just recently. The rallies can continue, there is lots of momentum, lots of dollars floating around, and about the easiest Fed that anyone can remember.

But there are some factors that might at least put a pause on the rally. Biden’s proposed capital gains tax is one, he proposed upping the tax on wealthy Americans to 43.4%, higher than the rate on wage income.

Both bitcoin and US stocks took a minor hit on the announcement, although stocks recovered by the weekend.

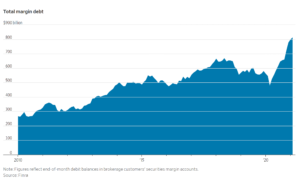

Excessive leverage in the system is a threat. Sometimes it shows up out of nowhere. Investments that went against Archegos Capital Management, which was wildly leveraged across multiple firms, caused $10 billion in losses. How many other Archegos’s are out there? How much leverage is tied up in bitcoin? What about in stocks?

Total margin debt closed out February at an all-time high. The 49% increase, year over year, was the fastest increase since 2007.

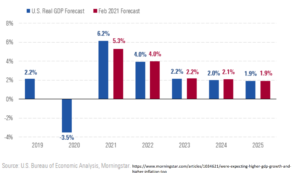

But on the plus side, the economy is beginning to boom. Of course, it has been helped by trillions in government and Fed stimulus. Morningstar, in line with other forecasts, just upped their read GDP for estimated growth to 6.2% this year.

And unemployment claims are starting to fall fast.

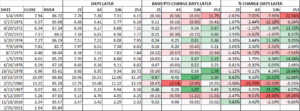

SCOREBOARD