February 2023: A Reversal of Fortune for Financial Markets

After a strong January, February shifted sentiment for financial markets. Key themes for the month included:

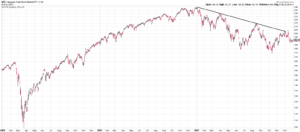

Equity Market Pullback:

- Major indices retreated after hopes for disinflation faded.

- The S&P 500 lost 2.4%, the Dow Jones 4.2%, and the Nasdaq 1.1%.

- Growth stocks outperformed value, and Information Technology was the only positive sector for the S&P 500.

Rising Interest Rates:

- The Federal Reserve hiked rates by 0.25%, but stronger-than-expected economic data pushed market expectations for further hikes upward.

- The yield on the 10-year U.S. Treasury note increased by 0.40% to 3.92%.

Economic Resilience:

- Robust jobs data, stronger retail sales, and higher producer prices indicated economic resilience.

- Consumer confidence, however, unexpectedly dropped, signaling potential concerns about the future.

Global Market Performance:

- Developed markets like the MSCI EAFE fell 2.1%, while emerging markets like the MSCI EM declined 6.5%.

Other Notable Events:

- February saw the appointment of Kazuo Ueda as the new Bank of Japan Governor, raising questions about the country’s monetary policy direction.

- U.S. home prices continued their downward trend, marking the sixth consecutive month of decline.

Overall, February was a month of adjustment for financial markets. The rally fueled by disinflationary hopes gave way to concerns about higher interest rates and the sustainability of economic growth.