HIGHLIGHTS

- Stocks were down in the US by 1.18% and by 0.34% outside the US.

- China and the US are “a long way” from a trade deal, according to Trump.

- Tensions with Iran increase.

- Earnings are coming in better than expected but still projected to be down year over year.

- The consumer is in good shape as indicated by a strong retail sales report.

- More interest in gold as the miners jump by almost 7%.

MARKET RECAP

US stocks fell by 1.18% and international stocks dropped by 0.34%. The S&P 500 did close at a record high on Monday but fell on Tuesday and Wednesday after Trump said that China and the US were “a long way” from a trade deal. Stocks rallied on Thursday when John Williams, president of the New York Fed, said that “it pays to act quickly to lower rates at the first sign of economic distress.” On Friday, stocks gapped higher at the open but closed at the low for the day, it was reported that the US Navy shot down an Iranian drone and that Iran had seized a British-flagged oil tanker. Despite tensions with Iran, oil fell by 7.5% for the week, as inventory levels have been increasing around the world and the growth forecast for oil demand was revised down by 100,000 barrels by the International Energy Agency.

EARNINGS

Earnings have been coming in better than expected so far, but still look like they will be down year over year. About 15% of S&P 500 companies have now reported, and earnings are projected to fall by 2.1% from last year, according to FactSet. That is better than the 3% decline as of the end of June.

Netflix took a big hit when after the company announced a decline in subscribers for the first time in almost 10-years. The stock fell by about 10%.

RETAIL SALES

Retail sales increased by a strong 0.4% from May to June and by 3.4% year over year. April and May’s sales were revised down, but the June increase was above expectations. Overall, this was considered a positive report and indicates the consumer is still in good shape. That was also reflected in strong earnings by the banks, which were helped by consumer lending, and by the airlines, based on planes filled with travelers. Jamie Dimon, CEO of JP Morgan said, “The consumer in the United States is doing fine. Business sentiment is a little bit worse, most probably driven by the trade war.”

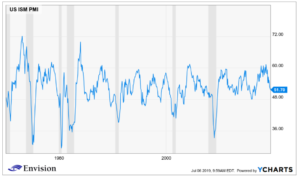

GOLD

We wrote that gold might be breaking higher on June 21 and it looks like traders are anticipating more. The GDX, an ETF composed of gold mining stocks, surged by 6.8% this week even though the base metal only increased by 0.7%. With global tensions around the world high (Iran/US) and interest rates ridiculously low, and maybe sniffing out unexpected inflation down the road, gold is catching interest. The long-term chart of gold below shows how gold has performed when it has cleared resistance lines.

SCOREBOARD