HIGHLIGHTS

- US stocks lost 15.26%. The S&P 500 is 32% off its high.

- The Fed cuts rates to zero.

- The economy is brought to a “sudden stop.”

- Unemployment claims are going to explode.

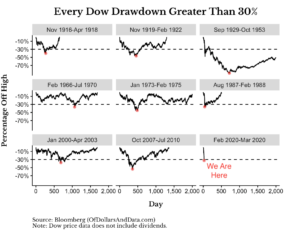

- Every Dow drawdown greater than 30%.

- There is no playbook.

- Ready or not Modern Monetary Theory is on the way.

- How to get out of this mess.

MARKET RECAP

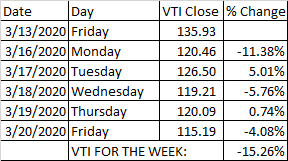

Stocks lost $4.3 trillion in value, and are now down by $12 trillion since the start of the bear market on February 14, according to Wilshire Associates. The S&P 500 was down 14.55% last week and is now off 32.23% from the high. The overall US stock market as measured by the Vanguard Total Stock Market Index (VTI) was down 15.26% for the week.

Last Sunday, the Fed announced they would cut interest rates to 0% to 0.25%, essentially as low as they can go without going into negative territory. Trump acknowledged that a recession might be on the way. Stocks then fell by 11.38% on Monday. Stocks rallied on Tuesday as the Fed began to try to help the debt markets to function better. Equities were hit hard on Wednesday, down by 5.76%, as stocks, bonds, and commodities all fell in unison in a race to raise cash. The Dow fell to below 20,000 for the first time since the beginning of 2017. Stocks had a small rally on Thursday, up 0.74%, after central banks put into place a series of measures to help the global economy. On Friday, stocks fell by 4.08% and closed at session lows as investors worried about exploding jobless claims and Goldman Sachs said Q2 US growth would fall by 24%.

Oil fell during the week to less than $20 per barrel.

The economy has essentially been brought to a “sudden stop” as hotels, restaurants, schools, and many other “non-essential” businesses have been closed. Social gatherings of more than a few been eliminated. In the span of a couple of weeks, we have become a stay-at-home nation in the attempt to slow down the spread of the Covid-19.

This is an experiment that has never been tried before, and it remains to be seen what the consequences are, but the stock market is not waiting to find out, assuming the worst, and then later thinking, it will be worse than that. A recession is almost definite and some are even mentioning the “D” word.

Unemployment claims hit 281,000 last week, which is up from 211,000 the week before. We have been close to 50-year lows on claims for a long-time, but this spike is just the beginning. There will be an avalanche of layoffs on the way. Treasury Secretary Munichin said unemployment could eventually hit 20% without government intervention. Other economic indicators were worse, the NY Fed Empire Manufacturing index fell to -21.5 from +12.9 in February, the biggest drop ever. The Philly Fed diffusion index for current activity fell to -12.7 from +36.7 last month, the lowest reading since 2012.

The Fed has been trying to do all it can, cutting interest rates, and trying to support the debt markets, but even treasuries have been falling in price of late. Interest raises have been rising, possibly due to the deficits that every country around the world is about start financing on a scale never seen before. Congress has already passed an $8.3 billion public health spending bill, followed by another $100 billion dollar bill for free virus testing and expansion of paid sick leave, and they are now working on a trillion-dollar-plus deal.

But for the most part, investors don’t see it as enough.

What happens when you close down large parts of the economy? We are about to find out. In the past, outside of the Great Depression, drops of 30% in the stock market have been good buying opportunities. But it feels like there is a lot more downside.

There is no playbook for this. The US has never voluntarily shut down large parts of the economy for a virus. Not in 1918 for the Spanish flu or any of the others. The government is attempting to do all it can, although no one has articulated a clear plan, other than throwing as much money as possible at the problem. Of course, one of the long-term problems is that the government doesn’t have any money to throw. We will be adding trillions to the already out of control debt. So ready or not, Modern Monetary Theory, the darling of the ultra-left, is about to get a real-time tryout.

What happens going forward is a function of what letter type recovery we have. If we get a “V”, then we have a somewhat quick recovery and before you know it, we are back to where we were and then beyond. A “U” would imply whenever we hit bottom, we stay there for a period of time (maybe extended time) and then ramp up to where we started. An “L” would be the more negative scenario, where we stay at a diminished level of economic output for a much longer time.

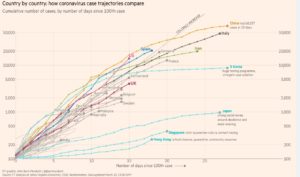

Last week we wrote that the country needed to take tougher measures to get the virus under control. We moved in that direction in a big way this week. That is what it will take to “flatten the curve”. Once China peaked out, the number of new cases began to decline daily (as if you are looking at a bell curve), and if the numbers are too be believed, there are relatively few new cases at this point. Time will tell if China can keep the numbers down.

If the US is fortunate enough to get to peak new cases in the next 10-days, we would next be on the downside of the curve, and then we can slowly begin to get back to a normal existence faster than almost everyone now believes. I may be way off base here and much too optimistic, but let’s hope. Some areas, like NYC, where there is a big breakout, might need longer. It took 50-days of quarantine in Wuhan to break the virus.

Whenever the US attempts to begin to get life back to normal, there has to be a rigorous test and trace program. South Korea set the standard (see above). Any sign of symptoms requires a test, and if positive, immediate quarantine, and then a trace of any possible contacts. The country needs a massive education program on how to wash hands. Any public business or place needs to have hand sanitizer readily available. We must practice social distancing and have regular temperature checks. We need to follow common sense. That is the only way to help keep the numbers down once we begin to dig ourselves out of this and until therapeutics and a vaccine are ready. With all of that, we can begin to return life to normal sooner rather than later.

SCOREBOARD