HIGHLIGHTS

- US stocks were flat and international stocks fall by 0.45% but lots of volatility during the week.

- Bonds drop 0.36%.

- The growth in the estimate of future earnings seems to have stalled.

- The US economy is strong but there is a rising risk of a global recession based on leading indicators.

- Sears files for bankruptcy

MARKET RECAP

US stocks were flat and international equities fell by 0.45%. While US stocks pretty much ended the week where they started that hides the fact that it was a wild week in between. Stocks were up by 2.2% on Tuesday on strong earnings reports and down by 1.45% on Thursday on geopolitical concerns. Bonds were down by 0.36% as interest rates about 5 basis points across the curve.

EARNINGS

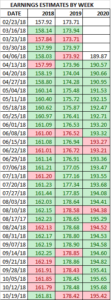

Solid earnings led to a massive rally on Tuesday, but overall, estimates of further increases in future earnings have stopped. This week, estimated earnings were revised down for 2019 and 2020. Earnings should still be up nicely in each of those years, but the consistent revisions up that we have seen for the past couple of quarters appears to be ending.

per Thomson/Reuters

JOB OPENINGS

There were 7.136 million job openings on the last day of August according to the Labor Department. That is 902,000 more than the amount of Americans who were actively looking for work. Prior to March, job openings were never greater than those looking for work in the entire 17-year history since these statistics have been kept. The labor market continues to be extremely tight.

GLOBAL ECONOMY

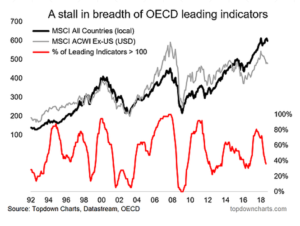

While the US economy continues to look strong, the same cannot be said around the rest of the world. There is a rising risk of a global recession. Equity markets often move in the same direction as economies around the world. When most countries leading economic indicators are operating above trend markets are generally rising. Likewise, when most countries are operating below trend, markets often fall.

The percentage of OECD countries (36 countries) with leading indicators above trend has dropped to 40% (see the red line below). In the big market sell-offs of 2000 and 2007 (see the black and gray lines below), economies deteriorated around the world to the point that almost every country was operating below trend when measured by the leading indicators. However, two times in recent years, the trend stopped at about 25%, and market rallies resumed without colossal sell-offs.

SEARS

The once-proud retailer Sear filed for bankruptcy. Sears has been headed in one direction, down, since hedge fund manager Eddie Lampert took over. This was more than just the impact of Amazon. Lampert did not invest in stores, Sear bought back stock at high prices, while the stores deteriorated. Lampert kept inventories at extra light levels, meaning they were often out of stock, stopped advertising via circulars and basically neglected the stores.

SCOREBOARD