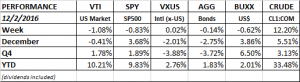

PERFORMANCE

The three-week post election win streak ended. US equities were down by 1.08%, international equities were flat and the aggregate bond index declined just slightly. The dollar was also down.

Energy shot higher by 12% on news of an OPEC production cut.

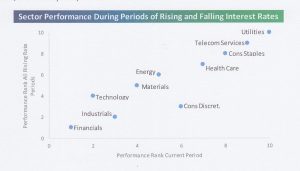

Financials have been the leading sector since the election and utilities the worst. That is in line with historical sector performance during periods of rising rates as shown on the graph below.

TRUMP

Trump had done a decent job acting presidential since the election. But some of his bad habits have reemerged over the last week. He started making some not so presidential type comments on his Twitter account. Writing that “millions of people” voted illegally. This sweeping statement was made without a shred of evidence. He started attacking individual reporters, attacked individual businesses and threatened 35% tariffs on businesses that move out of the country. This is how third-world dictators act and if it keeps up, it could threaten economic progress and have a negative impact on investor sentiment. Trump even attacked the SNL skits (and he was serious). This market rally has been built on the positives of the Trump agenda with the hopeful thought his temperament would remain under control and his worst instincts on trade would be held back.

EMPLOYMENT

The US unemployment rate fell to 4.6%, the lowest level since 2007, due to a decline in the workforce. Jobless claims rose to 268k. That is higher than recent reports but still historically low. The economy did ad 178k nonfarm jobs in November, October was revised down to 142k from 161k.

GDP

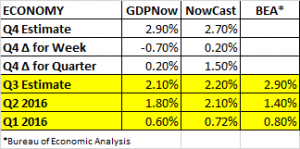

Q3 real GDP was revised up to 3.2% from 2.9%. That was the strongest increase in two years. Real GDP is now on track for 1.8% increase for the year, but that does not include Q4, which so far is projecting in the 3% area.

For Q4, GDP estimates came down to 2.9% from 3.6% on the GDPNow model. But the Nowcast model increased their Q4 estimate to 2.7% from 2.5%. Positives for the Nowcast model included the strong labor report and better domestic income numbers, offset by negative news on personal consumption expenditures.

Consumer Confidence

The Conference Board’s Consumer Confidence Index hit 107.1 in November. That is the highest level since July of 2007. As we wrote a couple of weeks back, “animal spirits” are in the air.

EUROPEAN UNION

There are more emerging signs that the European Union might be in trouble. A referendum vote today (12/4/16) in Italy rejected constitutional changes designed to streamline lawmaking and boost competitiveness. This was a win for the populists. However, in Austria, voters today rejected the presidential bid of a right-wing populist who was against immigration.