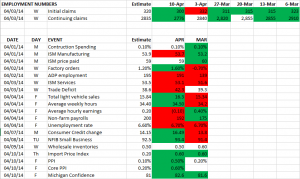

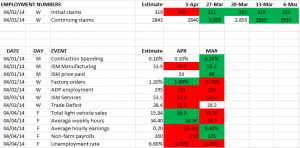

The economic stats were generally favorable over the past week. Employment numbers beat consensus. The initial claims number of 300,000 is a 7-year low. There has not been any negative blow up this month in any economic stats. The economy may not be flying, but it is maintaining slow growth. The MTD figures we track are below.

Monthly Archives: April 2014

Notes from Barron’s 4/14/2014

THE TRADER

DJI 16026.75 -2.35%

SP500 1815.69 -2.65%

Nasdaq Composite 3999.73 -3.10%

There has been a negative divergence between new highs and stock prices. As prices have advanced new highs were falling.

THE HIGHFLIERS ARE STILL TOO HIGH

FB, TWTR, LNKD, Z and CRM are still too high.

Jim Paulsen of Wells Capital Management says “My guess here is that we are having a valuation adjustment in one small part of the market, in the highflying momentum stocks that got ahead of themselves and are now correcting, I think this is more of a buying opportunity.” Paulsen bases that on good economic reports, resilient economically sensitive stocks and strong emerging markets.

The DOW is trading at a reasonable 13x 2014 estimated earnings.

JPM, GS, TRV and IBM have forward p/e’s of less than 10. Others that look reasonable are APPL, MSFT, INTC, CSCO.

AMGN, GILD and CELG have close to market multiples and profits are expected to double by 2017 at CELG and GILD.

FINANCIAL BIGS FACE OFF IN THE RING AT CAESERS

A battles between some heavyweight investment titans over bonds is heating up. One one side are the controlling shareholders of Caesars Entertainment (Apollo and TPG) and on the other side are believed to be Howard Marks of Oaktree and David Tepper of Appaloosa. Tepper and Marks might be part of a group of second-lien bondholders that have filed suit alleging that Caesers is moving assets out of the operating company and into Caesers Entertainment for inadequate compensation. The operating company is burning through lots of cash and may not be around much longer. The bondholders want to void the asset sales. Shares are probably overvalued given the litigation.

CHARTING A TASTY FUTURE FOR POST

POST is now less than 1/2 cereal. Acquisitions have moved the firm more into private-label foods and active nutrition products. CEO William Stritz is using a roll-up strategy that worked successfully at Ralcorp. Stock has doubled to $51 since the February 2012 spinoff. Down 15% in the past month. Andrew Lazar of Barclays has a $66 price target.

Active nutrition and private-label foods are highly fragmented markets. Gabelli recommended the stock at the Roundtable and said they could generate $500m in ebitda in three years. He said of Stiritz, “He is one of the great value-adders, like John Malone or Buffet.”

THE SEARCH FOR INCOME

Bill Gross says “We’re at the lowest level of reward to risk that we’ve ever seen.” Gross doesn’t expect fed funds rate increases until late 2015. He is keeping duration at less than the index value of 5.7 years by adding one to five year corporate bonds and cutting mortgage bonds to 1/3 from 1/2 two years ago.

Dan Fuss of LSBRX says that his GUESS is that the 10-year treasury will inch up to over 4% over the next 3-4 years. 30% of his portfolio is in short-duration bonds to prepare for buying opportunities ahead, “when you get rates up a couple of percent, the world is going to be populated with discount bonds, and the bond pickers of the world are going to be happy.”

You have to look at rising rates in three dimensions, (1) yield, (2) price and (3) impact of rising rates on the underlying business.

Rising rates are dangerous for companies that count on cheap credit to propel growth (same with some countries like emerging markets). Rising rates are good for companies with liabilities in nominal terms such as life-insurance, investment companies, large corporations and municipals with pensions liabilities.

Dividend paying stocks with limited growth can get hurt.

Hersh Cohen of SOPAX says “stocks are the best house in a tough neighborhood in which to find income.” Cohen says further “In an environment of rapidly rising rates, everyone loses but when rates rise slowly nobody has to lose.” Cohen expects a slow rise.

Cohen advises to focus on the companies that have good prospect for growth 10 and 20 years out and not to worry about every decline.

Some strategies:

Build a ladder (need at least six figures)- Individual bonds of different maturities. Will get full principal back as long as no defaults.

A basket of ETFs – William Valentine of Valentine Ventures recommends 40% in LQD or CORP, 20% in BWX or IGOV, 20% in VTIP and 10% each in JNK and PCY.

Opt for active management – DLTNX, DODIX, LSBRX

Dividend-paying stocks – SOPAX, VDIGX, PRFDX.

Municipals – VWITX and FTABX

High-yield bonds – SPHIX and NHINX.

Emerging markets

Unconstrained bond funds – BASIX and MWCRX

REITs – VGSIX and TRREX.

Closed-end funds – take advantage of discounts DSL (run by Jeff Gundlach, PCI, PPT, MGF.

Economic stats week ending 4/4/2014

Light vehicle sales way up

Light vehicle sales rose 6.9% in March to an annual rate of 16.3 million. This is the highest rate since February of 2007. We wrote on February 3rd that disappointing auto sales in January were probably the result of weather and this now appears to have been the case.

Notes from Barron’s 4/7/2014

MENU ITEM NO. 1: RESTORING STOCK’S BRIO

Bravo Brio Restaurant Group (BBRG) is down 20% since June to $14.71. Trades at 6x expected 2015 EBITDA versus 9+ for competition with a 6% FCF yield and an almost debt free balance sheet.

Will Slabaugh of Stephens thinks same store sales will turn positive in the second half of the year and stock can hit $18 in next year.

Analysts expect 81 cents this year and 95 cents next year. New restaurants generated 30 to 40% returns. Same store sales were down 2.8% last year. Possibly 40 to 50 new restaurants over the next five years.

$18m left in buyback plan which is about 6% of shares outstanding. Activist Red Mountain Capital owns 9.5% of its stock. Stephen Anderson of Miller Taback figures there is a 30% chance of a takeout with a $23 fair value.

———————-

GO AWAY IN MAY; IT’S A MIDTERM-ELECTION YEAR

Based on 68 years of data, political turbulence could cause a fall in the market in Q2 and Q3. Sam Stovall of S&P Capital IQ think the market is headed for a haircut this month or next. But the market should climb back to even rather quickly.

April to September might be subpar followed by a positive returns for Q4 and Q1 and Q2 next year. Since 1970 Q2 has averaged a 2.5% decline in the SP500 during midterm election years. But Barry Ritholtz of Ritholtz Wealth Management disagrees and says this year is “skewed decidedly positive,” but don’t expect an above average gain.

____________________________

THE TRADER

DJ30 16412.71 +.55

SP500 1865.09 +.40

The movement from growth to value continued as high flyers can hit hard this week. FB down 20% on the week.

DNKN trades at 27x. New Constructs says growth has been enhanced by a series of one time events. ROC is only 8.5% and 2014 earnings might be too optimistic. Consensus is $1.82 per share but same store sales while still increasing have been growing at a slower rate over the last three years.