The market got crushed today, dropping 2.30%. The VIX spiked by 43%, the most ever in one day. Commodities, especially metals, continued in free fall for the second straight day and hurt the market early on. The market was down about 1.35% when terrorists struck the Boston Marathon with a couple of bombs. The market would drop about 1% more after that.

Our comment on April 5 that gold might have had a false breakdown turned out to be wrong. Gold was strong for two more days but then finished on the low on April 10th. That would have been the signal that gold was headed further down. Gold collapsed two days later. But we also wrote on April 5, as well as April 4, that there has been a change in behavior in the market and remarked about the increase in volatility. For the first time, a couple of commentators even wrote today about the end of the bull market that started in 2009. Wow. We will have to see where the market takes us from here but a correction is long overdue.

If you have the guts, now is probably a good time to begin accumulating a position in the metals and miners and then dollar cost average down. The best trades are always the hardest trades. We like PAAS and AUY (but there might still be significant downside from here).

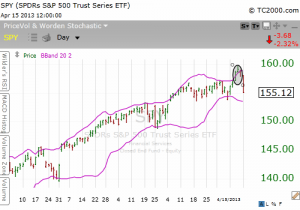

CHART BREAKDOWN

Look at the shaded ellipse from April 10 to April 12. It looks like a possible top. The market finished strong on April 10, opening at the low and then finishing at the high. On April 11, the market opened at the close from April 10th, pushed higher but closed at the midpoint of the day. The close was more than two standard deviations above the 20 day moving average. then on April 12, the market pushed lower, but it closed above the midpoint. Had the market closed lower that day it would have been more bearish. Closing above the midpoint might even be considered bullish, but the massive dropped today negated that. I would guess that the April 11 high was some kind of top, but it might just be a short term top.