MARKET RECAP

- US stocks -0.28%, international -0.41%, bonds -1.19%, crude +3.57%.

- CPI was up 3.8%, higher than expected.

- PPI was up 0.6% in February versus the economists’ estimate of 0.3%.

- CPI and PPI have been moving in the wrong direction but the market is acting like everything is just fine and that interest rates will fall later in the year. Economists are generally abandoning their recession calls. Jamie Dimon said the world is pricing in a 70-80% chance of a soft landing. He gives the soft landing 50% odds and 50% for stagflation.

- Retail sales were up 0.3% versus an expectation of 0.4%.

- Bond yields increase; the 2-year is up by 24 basis points to 4.72%, and the 10-year increased by 22 basis points to 4.31%.’

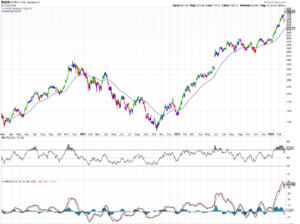

- The S&P 500 has not fallen by more than 2% since October, which is the longest streak in six years.

- According to S&P Global Ratings, companies worldwide are defaulting on their debt at the fastest rate since 2009.

- The Intelligence Advisors Sentiment Report showed bullishness (of market newsletters) measured at 60.9%. The last time the measurement was greater than 60% was in April and July of 2021.

SCOREBOARD