MARKET RECAP

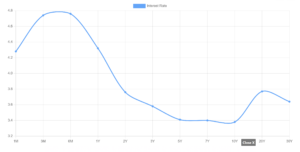

Stocks moved ahead for the week, in the US at +2.05% and outside the US at +2.79%. The market is still trading at a somewhat high level, given where interest rates are. The 5.3% earnings yield on the S&P 500 is barely above the almost 5% that treasuries yield going out up to 2 years. This is a divergence that, over the long run, likely won’t hold.

The market expects rates to top out at 5.25% to 5.5%, with the next hike to be 25 basis points. But with a hotter-than-expected economy, there is now a push to go for 50 basis points.

The economy, so far, is still advancing. The Atlanta Fed GDPNow shows Q1 GDP at 2%+, and the ISM services index stayed at 55.1, indicating an expanding economy. At the same time, though, the ISM manufacturing index is 47.7, indicating a contracting economy. Global PMI is now north of 50.

Warren Buffet took a direct shot at President Biden when he said in his annual letter, “We you are told that all [share] repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you are listening to an economic illiterate or a sliver-tongued demagogue.”

SCOREBOARD