MARKET RECAP

Fitch downgraded US debt to AA+ from AAA a couple of weeks back. Fitch said the downgrade was due to an “erosion of governance” in the US compared to other top-tier economies over the last two decades. The Biden administration and many “experts” said the downgrade was undeserved and nonsense. Treasury Secretary Yellen said, “The change by Fitch Ratings announced today is arbitrary and based on outdated data.” But in all seriousness, who can argue with the downgrade?

Look what is going on in this country:

- For the first time in our history, we did not have a peaceful transfer of power after the 2020 election.

- The last President has been indicted multiple times and still insists the last election was stolen, and many people actually believe him.

- We have gone to the brink several times when renewing the debt limit.

- Trump added $6.7 trillion in debt from fiscal year 2017 to fiscal year 2020, an increase in the national debt of 33% in four years. At the end of fiscal year 2020, the national debt was $26.9 trillion.

- Under Biden, in January of 2023, the national debt hit $31.4 trillion.

- The cost of refinancing the debt at higher interest rates is going to compound the problem.

- Spending is just out of control, and hardly anyone cares.

So the downgrade was well deserved and should probably have been deeper.

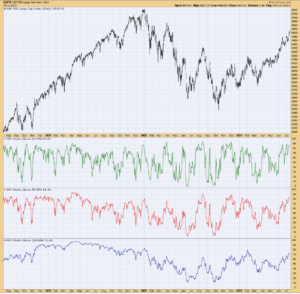

SCOREBOARD