MARKET RECAP

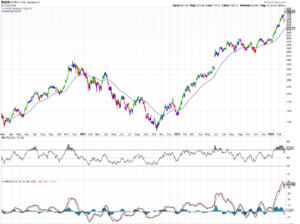

2023 went into the financial history books at the Friday close, with blockbuster gains for the year. The S&P 500 finished with a total return of 26.72%, foreign markets were +15.10%, and bonds were +5.04%. The US dollar declined by 2.04% and oil fell by 10.73%. Bitcoin was up by 156% as of midday on December 31st.

No one expected this; the Fed continued to raise interest rates, and the consensus was that a recession was coming. The war between Ukraine and Russia continued, and a new one broke out between Israel and Hamas. There was a banking crisis in the first half of the year, but none of that stopped the market (although there were some pullbacks during the year).

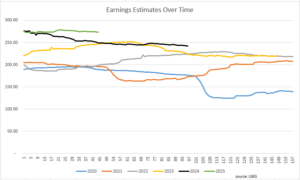

The excitement generated by artificial intelligence, falling inflation, the belief that the Fed is done hiking and that interest rate declines would be on the way in 2024, earnings that held in there, and a strong consumer and labor market were all enough to keep the market climbing a wall of worry to dramatic gains. Even Taylor Swift helped; her record-breaking tour was like a mini-Super Bowl in every city she traveled to during the year.

As it ends, the S&P 500 closed the year at 4,769.83, just off of the all-time high set almost two years ago, on January 3, 2022, at 4,796.56. So right now the market shows a double-top. The last time the market was at this level, it didn’t work well.

The yield on the 10-year treasury started and ended at about the same place, 3.88% to close the year versus 3.83% at the end of 2022, but it was a wild ride in between. The yield fell as low as 3.30% in April and then climbed all the way to 4.98% in October before falling back to 3.88%. When interest rates began to spike, several banks failed, including Silicon Valley Bank and First Republic Bank. These banks got caught short-handed by owing a portfolio that was heavy in long-dated bonds, which were purchased when interest rates were much lower, resulting in huge mark-to-market losses. The Fed ended the crisis by saying they wouldn’t let depositors lose money, even if it was above the FDIC limits, ending potential bank runs.

The big spike for the year in yields, which did hold, were short-term treasuries due to the Fed raising interest rates. The 3-month yield started at 4.45% and ended at 5.40%. It peaked at 5.63% in October. After years where interest rates were essentially zero, the high rates sent a tidal wave of cash into money market funds.

The consensus going into 2024, is that stocks will return 7-10%, Many still expect a recession, albeit a soft one. But as we know and especially learned in 2023, the consensus is often wrong.

Here is to a Happy New Year to everyone!

SCOREBOARD