MARKET RECAP

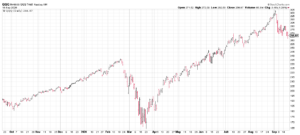

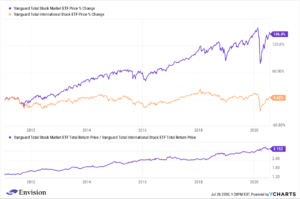

Stocks fell for the third straight week as technology stocks continued their fall from grace. Amazon dropped 5.2%, Facebook 5.3%, Apple was down 4.6% and Google lost 4%. Since the September 2nd closing high, the overall US market as measured by the VTI is down 6.7% and the Nasdaq as measured by QQQ is down 11.9%.

The VTI (total US stock market) hit a new low on Monday, rallied slightly during the week, and then touched the low again on Friday before bouncing to close off the low. The Qs (Nasdaq 100) was not so fortunate, breaking down to a new low on Friday, in what might indicate further downside.

Despite the recent fall, there are still signs of excess in the market. Snowflake (SNOW) went public in what was the biggest initial public offering of a software company ever. Priced at $120, the stock soared to $245 in the initial trade, giving the company a market value of $68 billion or 110 times revenue.

The Fed said during the week that the economic outlook is highly uncertain and said they would keep interest rates at close to zero for three more years and would continue to buy $120 billion of agency mortgage-backed securities and treasuries each month. The Fed also updated their guidance and said the Fed would need to see evidence of a tight labor market and that inflation will “moderately exceed 2% for some time” before considering raising rates. Paul Volker must be rolling over in his grave.

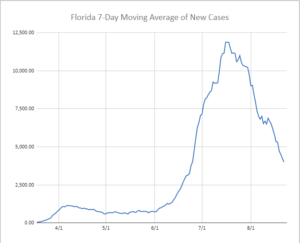

US retail sales increased for the fourth straight month but the pace was slower than earlier in the summer. August sales were up by 0.6% over July and were above pre-pandemic levels. The retail sector has recovered well, unlike other parts of the US economy, which still trail pre-pandemic numbers. Meanwhile, in China, retail sales have rebounded to pre-pandemic levels. Q2 growth was up 3.2% compared to a 6.8% decline in Q1. China has had the pandemic more or less under control since its initial outbreak.

Mortgage data firm Black Knight Inc. says about one million homeowners are behind on their mortgages and could be in danger of losing their homes when restrictions on evictions and foreclosures expire.

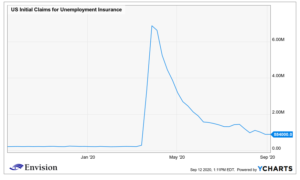

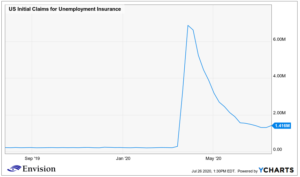

Initial claims for unemployment fell by 33,000 to 860,000 last week.

SCOREBOARD