MARKET RECAP

- S&P was down by 0.3%, the Dow by 0.9%. International stocks were up by 1.32%.

- December inflation came in a 7% year over year, the highest rate in 40-years.

- Market is anticipating rate hikes, but still thinks they top out at around 1.6% in about 2024 while the 10-year is projected to be at about 2% in two years. That sounds low to us.

- Meanwhile the Fed is still buying 60 billion in securities per month.

- Fed speakers are confirming three one-quarter rate increases but markets are beginning to price in a 4th hike in December.

- The Nasdaq is down about 5% year-to-date while deep value stocks are up. The Invesco S&P 500 Pure Value fund is up 7% while the Pure Growth fund is down 7%.

- The Barron’s Roundtable, normally an optimistic bunch, is looking for inflation to continue and stocks to fall in the first half of the year, followed by the possibility of a more stable market and positive returns in the second half.

- Retail sales fell by 1.9% in December.

- Companies are trying to take advantage of low interest rates before they begin to go higher, $100 billion was raised by investment grade companies in the first nine business days of the year.

- The Real GDP growth estimate for Q4, which in November was as high as 9%, has now fallen to 5%, showing the impact of Omicron as the year closed-out.

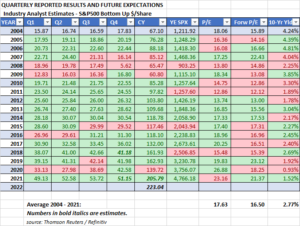

SCOREBOARD