Category Archives: Uncategorized

A Look Back at Corrections/Pullbacks

The market is down about 9% from its recent high on 11/3/2015. So we are bordering on a correction, normally defined as a drop of 10% or more. This is not the first correction and it won’t be the last. Here is a look back at pullbacks and corrections since the summer of 2005.

| DATE OF | DATE OF | DAYS | CLOSE ON | CLOSE ON | PRICE | VIX | VIX | VIX |

| HIGH | LOW | HIGH DATE | LOW DATE | CHANGE | LOW | HIGH | CHANGE | |

| 9/9/2005 | 10/13/2005 | 34.00 | 124.60 | 117.43 | -5.75% | 13.5 | 16.47 | 22.00% |

| 5/5/2006 | 6/13/2006 | 39.00 | 132.52 | 122.55 | -7.52% | 11.62 | 23.81 | 104.91% |

| 2/20/2007 | 3/5/2007 | 13.00 | 146.04 | 137.35 | -5.95% | 10.24 | 19.63 | 91.70% |

| 7/19/2007 | 8/15/2007 | 27.00 | 155.07 | 141.04 | -9.05% | 15.16 | 30.67 | 102.31% |

| 10/9/2007 | 11/26/2007 | 48.00 | 156.48 | 140.95 | -9.92% | 18.88 | 28.91 | 53.13% |

| 12/10/2007 | 1/22/2008 | 43.00 | 152.08 | 131.54 | -13.51% | 20.74 | 31.01 | 49.52% |

| 5/19/2008 | 7/15/2008 | 57.00 | 143.05 | 120.99 | -15.42% | 17.01 | 28.54 | 67.78% |

| 8/11/2008 | 11/20/2008 | 101.00 | 130.71 | 75.45 | -42.28% | 20.12 | 80.86 | 301.89% |

| 1/6/2009 | 3/9/2009 | 62.00 | 93.47 | 68.11 | -27.13% | 38.56 | 49.68 | 28.84% |

| 6/2/2009 | 7/8/2009 | 36.00 | 94.85 | 88.00 | -7.22% | 29.63 | 31.3 | 5.64% |

| 10/19/2009 | 10/30/2009 | 11.00 | 109.79 | 103.56 | -5.67% | 21.49 | 30.69 | 42.81% |

| 1/19/2010 | 2/8/2010 | 20.00 | 115.06 | 105.89 | -7.97% | 17.58 | 26.51 | 50.80% |

| 4/23/2010 | 7/2/2010 | 70.00 | 121.81 | 102.20 | -16.10% | 16.62 | 30.12 | 81.23% |

| 8/9/2010 | 8/26/2010 | 17.00 | 112.99 | 105.23 | -6.87% | 22.14 | 27.37 | 23.62% |

| 2/18/2011 | 3/16/2011 | 26.00 | 134.53 | 126.18 | -6.21% | 16.43 | 29.4 | 78.94% |

| 4/29/2011 | 6/24/2011 | 56.00 | 136.43 | 126.81 | -7.05% | 14.75 | 21.1 | 43.05% |

| 7/7/2011 | 10/3/2011 | 88.00 | 135.36 | 109.93 | -18.79% | 15.95 | 45.45 | 184.95% |

| 10/27/2011 | 11/25/2011 | 29.00 | 128.53 | 116.31 | -9.51% | 25.46 | 34.47 | 35.39% |

| 12/7/2011 | 12/19/2011 | 12.00 | 126.73 | 120.29 | -5.08% | 28.67 | 24.92 | -13.08% |

| 4/2/2012 | 6/4/2012 | 63.00 | 141.84 | 128.10 | -9.69% | 15.64 | 26.66 | 70.46% |

| 9/14/2012 | 11/15/2012 | 62.00 | 147.24 | 135.70 | -7.84% | 14.51 | 17.99 | 23.98% |

| 5/21/2013 | 6/24/2013 | 34.00 | 167.17 | 155.73 | -6.84% | 13.37 | 20.11 | 50.41% |

| 1/15/2014 | 2/3/2014 | 19.00 | 184.66 | 174.17 | -5.68% | 12.28 | 21.44 | 74.59% |

| 9/18/2014 | 10/16/2014 | 28.00 | 201.82 | 186.27 | -7.70% | 12.03 | 25.27 | 110.06% |

| 5/21/2015 | 8/25/2015 | 96.00 | 213.50 | 187.27 | -12.29% | 12.11 | 36.02 | 197.44% |

| 11/3/2015* | 1/8/2016 | 66.00 | 211.00 | 191.92 | -9.04% | 14.54 | 26.39 | 81.50% |

*The correction that started on 11/3/2015 is still in progress.

SEC adopts new Crowdfunding regulations

On October 30, 2015, after three and a half years of proposals, comments, and discussion, the Securities and Exchange Commission (SEC) announced its final rules on equity crowdfunding for small businesses. The forms that funding portals use to register with the SEC become effective on January 29, 2016, while the final regulations take effect on May 16, 2016.

Small businesses considering this new financing alternative will want to review the new regulations carefully.

Recap for December/Q4/2015

Major market indexes finished just about flat in 2015, but that disguised some pain as many stocks and sub-indexes were in the red for the year. The SPY was the star performer, up 1.27% for the year (including dividends), the overall US market (VTI) gained 0.36%, and international markets (x-US) lost 4.20%. The aggregate bond index (AGG) managed a gain of 0.48%.

For Q4, the SPY advanced 7.02%, VTI 6.24%, VXUS 2.57%. The bond index (AGG) fell 0.51% as the Fed raised interest rates in December. However, the year did not end on a good note despite the positive Q4 returns for equities. For December, the SPY dropped 1.73%, VTI -2.13%, VXUS -2.18% and the AGG -0.19%.

The market topped out on May 21, and then suffered a 12.29% correction that ended on August 25. The market rallied from there but did fall 5.2% between November 13 and December 20th.

Underneath the positive SPY and VTI numbers, most equities were down. Take out eight large-cap out performers like MSFT, AMZN, FB and GOOGL/GOOG, and the SP500 would have down by 4% according to Jessica Binder Graham of Goldman Sachs.

For the year, the midcaps (VO) fell 1.35%. Small-caps as measured by the IWM fell 4.46%. Dividend growers fell (VIG) 1.92%. Emerging markets (VWO) were down 15.82%. The big winner was large cap growth as measured by the QQQ, up 9.43%. Materials (XLB) were down 8.65% and energy (XLE) was down 21.47%. Consumer discretionary (XLY) was up 9.93%.

Market Timing is Back in the Hunt

An article in Institutional Investor, written by researchers at AQR, suggests that small adjustments from market timing signals, as opposed to binary (all in or out) decisions, might help performance. Click for the article.

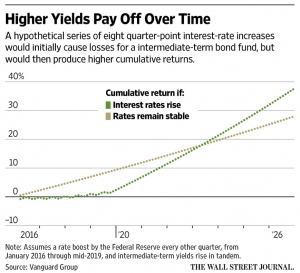

What Happens to Your Bond Fund When Interest Rates Rise

November Recap

The market etched out a gain in November. The overall US market as measured by the VTI gained 0.63%. The SPY was up 0.39%. International x-US (VXUS) dropped 1.32% and the aggregate bond index (AGG) fell 0.42%. The treasury curve flattened slightly. The 2 and 5-year notes were up by 19 and 13 basis points while the 10 and 30 year both increased by 5 basis points.

The financial sector (XLF) was the big winner, plus 1.99%. Higher anticipated interest rates was the driver. On the flip side, utilities dropped 2.13% for the same reason. Commodities took a major tumble. Gold (GLD) was down 6.75%, silver (SLV) down 9.19%, oil (USO) down 12.69% and agriculture (DBA) down 3.62%. Commodities were hurt by more weak economic news from China. Imports fell 19% there.

During November it became clear that the Fed will hike rates in December. Strong job numbers are too favorable to ignore. October payroll was up 271,000 versus an estimated 185,000. The unemployment rate dropped to an even 5.00%. Average earnings were also up.

The anticipated interest rate hike dropped the SP500 3.6% for the week ending 11/13. But it rallied the following week when minutes released by the Fed made clear that the pace of interest rate increases would be slow.

Terrorism tried to interfere with the markets with a brutal attack in Paris by ISIS on Friday night, the 13th. But the market shrugged that off with a 1.5% gain on the following Monday. Later in the month, Turkey shot down a Russian jet. Another indication that the world is becoming a more dangerous place.

October Recap

Score one for bulls. There was lots of fear that the market was headed for tumble coming out of September, but October turned into a positive run as the VTI (US market) advanced 7.88%, the SPY (SP500) +8.50% and the VT (international x-US) +6.86%. The SP500 is now back into the middle of the range it held from February until August. However, a good portion of the advance is made up of a smaller list of higher cap “momentum” stocks such as AMZN, GOOGL and FB. If you look at the overall US market (VTI), it is just cracking the bottom of its range. This lack of equal participation may be a warning signal that we moved to far too fast.

The AGG (aggregate bond index) finished a few basis points above breakeven at +0.07%. Treasury rates were up slightly, the 2-year +11 basis points, 5-year +15, 1-year +11 and the 30-year +8.

Credit spreads narrowed during the month, lowering fears that the bond market might be on to something much worse, and providing fuel for M&A. The ECB indicated it might purchase more bonds, lower interest rates in China, and indications that China is in for a softer landing, all helped the markets.

This week the Fed talked tough and indicated there was a good likelihood for a December rate increase. Economic conditions remain similar to September, when it seemed like the Fed would never raise interest rates. But a slightly better outlook from China and a strong market might be pushing the Fed to a more aggressive stance. We will see if they follow through.

Turnaround Friday

Friday turned into a dramatic day. Whether it turns out to be a marker for the end of this correction time will tell. The futures opened higher but when the 8:30 unemployment report came out the market plunged. The report was a huge disappointment and included lower revised numbers for July and August also. The market was down 2.2% at one point. But then it all turned around and the market just kept rising. The SPY closed up 1.49% on the day at an even 195. The SPY now sits on a resistance line that has marked about 12 other high, low or closes in the last 28 days.

The market has had the chance to move lower on each of the first three days in October, but has now closed at or very close to the high on all three occasions. Another positive is that the market normally performs well in the final quarter of the year. We will see if there is any carry through this week.

Q3 Recap

Q3 Recap

Summary

The correction the markets have long been waiting for arrived in Q3. A correction, a decline of 10% or more, last happened in Q3 of 2011. The market hit its high on the SP500 (SPY) on May 21 at 213.50 and at least so far, the low was on August 25 at 187.27, dropping 12.4%. Since then, it has been mainly sideways action bounded by 200 on the top and 188 at the low, with lots of up and down in between. The market closed the quarter on a downswing at 191.63 although the 30th was a positive day.

All of the equity indexes were down for the quarter. Emerging markets were hit hardest, down almost 18%, followed by international markets. The SP500 fell 6.44% for the quarter and the overall US markets as measured by the VTI were down 7.28%. The aggregate bond index, which is mostly composed of treasuries, managed a 1.34% advance. All of these numbers include dividends.

| INDEX/ETF | SEPTEMBER | QUARTER | YTD |

| VTI (US MARKET) | -2.92% | -7.28% | -5.53% |

| SPY (SP500) | -2.49% | -6.44% | -5.39% |

| VT (INTL MARKETS X-US) | -3.24% | -9.25% | -5.98% |

| VWO (EMERGING MARKETS) | -2.90% | -17.95% | -15.25% |

| AGG (AGGREGATE BONDS) | 0.81% | 1.34% | 0.86% |

Economy

At the beginning of the quarter the fear was of a Greek default and the uncertainty of a Fed rate increase. After lots of drama, the Europeans managed another deal to kick the can down the road. That settled the markets and allowed for a July advance. But uncertainty about a Fed rate increase, a slowing China, and falling commodity prices doomed the market in August and September.

The Fed still has not raised interest rates, and they might have missed their window. Zero rates should be for an economy in a real crisis mode, as we were back in 2008 and 2009. We have long ago left that era. And while growth has never been gangbusters, it has been slow and steady, and there were numerous opportunities along the way to begin a very slow and gradual liftoff of rates. If the economy were to show signs of slowing, the Fed could simply halt the increases. The problem with artificially low rates is that it encourages activity that would not be optimal had money been priced at market rates. This hurts the economy over time. The other problem is that uncertainty as to the timing of rate increases has caused lots of damage to the market as investors have become ridiculously focused on if, when and how much. As has become the norm for this Fed, they kept to the same script and did not raise rates in September. The market reaction was not positive. The SPY was up above 200 to the upside in anticipation of an increase, but when the announcement came we closed just below 200 and then the market fell 5.8% to 188.12 over the next couple of weeks. Either the Fed was being too cautious like it often is, or they have greater insight into a slowing economy.

China was cited in the Fed’s statement. And a hard economic landing in China, due to a contracting manufacturing sector has spooked world markets. A slow China led to tumbling commodity prices which devastated emerging markets (see the VWO above) around the world. China’s direct impact on the US economy is not that big, an estimated 1% or so of the US GDP. But if China’s slowdown hurts the rest of the world that can eventually will hurt the US.

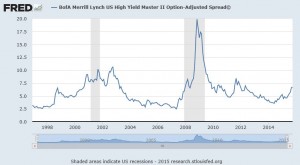

Another negative signal is the rising spread between high-yield and treasuries. A rising spread might indicate the threat of recession.

Markets

While corrections are frightening they are part of normal market behavior. Bigger market declines, called bear markets, defined as a drop of 20% or more, also happen but less so. They are generally associated with recessions. So a lot of the threat of a potential bear market has to do with if a recession is on the way here in the United States. So far that risk is appears low, the US economy seems to be moving slowly forward as it has been (note – employment numbers released on October 2 indicated a slowing economy). Globally, there is a greater threat of a recession due to China.

Another key factor is the valuation of the market. Is the market overvalued, fairly valued, or undervalued? Surprise! There is no clear answer to that. There are valuation models that can put you in either of the three camps.

An analysis of the CAPE ratio argues that this market is still overvalued. The CAPE ratio is the cyclically adjusted price-earnings ratio. It is a 10-year earnings average of the SP500 adjusted for inflation. The ratio is at about 25 and the historic average is about 17. A market fall of 30% would get us to average. However, it can take years for the market to adjust and this has not been a reliable indicator recently. The ratio understands ‘true’ average earnings during an expansion, says Minnesota State University Professor Stephen Wilcox. Changes in accounting methods and taxes over time make it difficult to compare different time periods. The market has been overvalued based on the CAPE ratio for a long time.

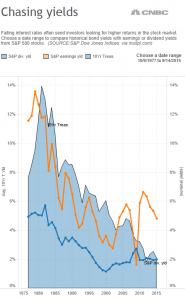

A comparison of the earnings yield of the SP500 versus the 10-year treasury rate shows that the market is undervalued. The earnings yield, earnings divided by price, is normally less than the 10-year treasury rate. But for the last few years, the earnings yield has been greater. Likewise, the dividend yield on the SP500 at 2% is roughly equal to the 10-year treasury yield. This also is unusual. So investors can get the same yield as a treasury and get all the upside of future growth by investing in equities. These are all strong arguments that the market is undervalued.

Performance of Equity and Fixed Income Markets

For Q3, in terms of equity sectors, the REITs as measured by the VNQ managed a 2.14% advance. The VNQ fell 10.52% in the prior quarter but as the threat of interest rate increases seemed to decline the sector posted a slight rebound, not to mention that real estate in the US continues to do well. Energy (XLE) and materials (XLB) got obliterated, falling 17.92% and 16.95%. For the year, there is a trio of double digit losers, energy is down 21.02%, materials is down 16.56% and industrials (XLI) fell 10.45%. The only sector that is up is consumer discretionary which increased by 3.98%.

For fixed income in Q3, the aggregate bond index (AGG) moved up by 1.34%. Long-dated treasuries (TLT) were the big winners, plus 5.79% but that followed a loss of 9.68% in last quarter. High-yield bonds as measured by the HYG fell 4.92%. Year to date the AGG is up 0.86%, the 7-10 year treasuries (IEF) was the sweet spot, increasing 2.90%. Preferreds were also strong (PGX), +2.71%. The HYG is down 4.13% for the year.