HIGHLIGHTS

- US stocks were up by 0.70%.

- Fed Chair Powell seems to have given the go-ahead to a rate cut later in the month.

- A rate cut in a growing economy, with unemployment at close to record lows, with no liquidity crisis, and markets at all-time highs would be unusual to say the least.

- But it does bring back memories of 1924 and 1998.

MARKET RECAP

Stocks continued their march higher, advancing by 0.70% for the week, as Fed Chair Jerome Powell pretty much confirmed that a rate cut is on the way.

DON’T FIGHT THE FED

Federal Reserve chair Jerome Powell seemed to give the green light to an interest rate cut later in the month in testimony to Congress this week. While Powell did not say that a cut is definitely on the way, his testimony seems to be leaning that way. Powell highlighted risks to the economy including the trade war, a global economic slowdown, Brexit, and an exploding deficit. The idea now for a rate cut would be to reduce the risks of a recession before the wheels of the economy start moving downhill. Powell said: “The bottom line is, the economy is in a very good place, and we want to use our tools to keep it there.”

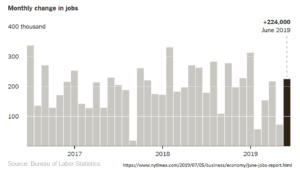

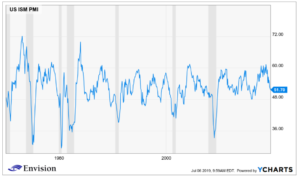

Usually, rate cuts happen when inflation is moving higher and/or there is visible stress in the economy. And usually, the Fed is starting from a higher base. Not this time. While the US economy is slowing it is still in slow-growth mode, asset markets are priced at all-time highs, the unemployment rate and the initial claims for unemployment are essentially at all-time lows. Liquidity is everywhere. A rate cut in an economic environment like this has harkened back memories to two other similar Fed moves.

New York Fed Chair Ben Strong cut rates in May, June, and August of 1924 to the lowest rates that were ever set by the Fed. The cuts were not in response to a weak US economy, but rather, to help Britain attract gold back into their country. The cuts led to a wave of speculation. The Fed eventually raised interest rates back to 4% but cut again in March of 1926, not because of a weak economy (the economic outlook was good), but because of a 9.1% sell-off in the Dow. Fed Board member Adolph Miller, the only dissenting vote, said this is “the most costly error committed by it or any other banking system in the last 75 years.” That led to more speculation and eventually the 1929 crash, helped along by a huge trade war (Smoot-Hawley tariff).

In 1998, the Fed reduced rates from 5.5% in September to 4.75% in November and would keep them flat until the following summer when they began to increase rates again. The Fed cut was in response to the Asian financial crisis, a Russian debt default and the near-collapse of the hedge fund, Long-Term Capital Management. The US economy was in good shape at the time, inflation was low, US equity markets were close to all-time highs, and markets were liquid. The market kept right on rising until the crash of 2000.

Time will tell what happens down the road, but for now, the age-old adage of “don’t fight the fed” appears to be the rule of the day.

SCOREBOARD