MARKET RECAP

It was a somewhat flat week, stocks did hit a record on Thursday but a pullback dropped the US by 0.34% and international markets by 0.20%.

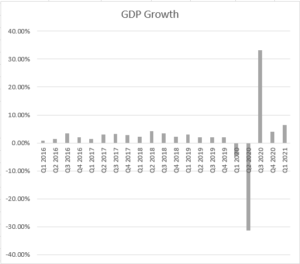

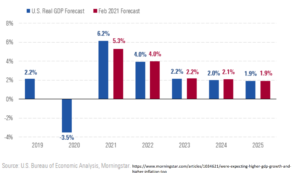

GDP grew at a 6.5% annual rate in the second quarter, up from 6.3% in the first quarter. The size of the economy is now greater than its pre-pandemic level. But while growth is expected to be maintained, the future is more cloudy as the Delta variant is spreading quickly, prompting the CDC to recommend wearing masks indoors.

Average home-prices increases set a record in May, up by 16.6% compared to last year, up from the 14.8% growth rate the prior month, as measured by the S&P CoreLogic Cash-Shiller National Home Price Index. The median home price in June was $363,300, up by 23.4%, according to the National Association of Realtors. These number make it even more absurd that the Fed continues to keep interest rates extra low by buying $120 billion a month in Treasurys and mortgage bonds.

The Fed did hint this week that those purchases would be evaluated soon, in a statement, the Fed said, “the economy has made progress towards these goals…[and would] assess progress in coming meetings.” But Powell made it clear that raising rates was not on the table, “It’s not something that is on our radar screen right now.”

A key inflation indicator eased slightly this week. Consumers surveyed by the University of Michigan expect inflation five to 10 years from now to be 2.9% down from 3% in May and closer to the 2.8% average in surveys from 2000 to 2019. And the recent fall in interest rates seems to indicate that bond investors are not worried either. However, on the other hand, inflation has been the big topic on earnings conference call. According to Bank of America Global Research, inflation was discussed at a rate 10x higher than last year.

SCOREBOARD