SCOREBOARD

Category Archives: Uncategorized

August 2023 Recap

August 2023: A Month of Two Halves for Financial Markets

The summer heat wasn’t the only thing that cooled down in August. After a promising July, financial markets faced a reality check and retreated across most asset classes. Here’s a breakdown of the key themes:

Equity Market Tumble:

- Major indices retreated, ending the month on a sour note.

- The S&P 500 lost 1.5%, the Dow Jones slipped 2.0%, and the NASDAQ dipped 2.1%.

- The first half rally fizzled out, with all major sectors ending the month in negative territory.

Rising Interest Rates:

- Hawkish rhetoric from Fed officials and stronger-than-expected economic data revived concerns about higher interest rates.

- The 10-year Treasury yield climbed from 3.75% to 4.15%, reflecting investor expectations of further tightening.

- This put pressure on equities, particularly growth stocks sensitive to higher borrowing costs.

Mixed Global Performance:

- International markets experienced a more pronounced downturn.

- The MSCI EAFE fell 3.8%, dragged down by European worries and a stronger dollar.

- Emerging markets suffered even more, with the MSCI EM tumbling 6.2% amidst concerns about China’s slowing economy and geopolitical tensions.

Economic Data Rollercoaster:

- Positive job numbers and retail sales were overshadowed by weaker consumer confidence, mortgage applications, and manufacturing activity.

- This mixed bag left investors uncertain about the true state of the economy and its future trajectory.

Other Notable Events:

- China’s property sector turmoil triggered fears of contagion in global markets.

- Tensions between the US and China regarding Taiwan continued to cast a shadow on sentiment.

- The war in Ukraine remained a source of concern and uncertainty.

Overall, August 2023 painted a picture of financial markets adjusting to a changing environment. The initial optimism fueled by easing inflation and strong earnings gave way to anxieties about rising interest rates, slowing economic growth, and geopolitical risks. The next few months will be crucial in determining whether this pullback is a temporary correction or a sign of a more extended downward trend.

Week Ending 08/25/2023

MARKET RECAP

- US stocks were up by 0.73%, international +0.72%, bonds +0.26% but for August, US equities are down by 4.27%.

- The 2-year yield is now at 4.98%. The 10-year is at its highest level since 2007 at 4.34%.

- Earnings estimates have been trending up for the last three weeks.

- The GDPNow estimate is ripping up at +5.9%, but two retailers, Macy’s and Dick’s, indicated some problems, higher theft, and credit card delinquencies. Dick’s missed estimates.

- Powell spoke on Jackson Hole and left open the possibility of a September increase.

SCOREBOARD

Week Ending 8/18/2023

MARKET RECAP

- US stocks -2.16%, international -3.03%, bonds -0.47%.

- Interest rates are up by 21 basis points on the 10-year to 4.30%. Rates were as high as 4.33%, the highest rate since 2007.

- GDPNow is tracking at 5.8%, a stronger economy is pushing up rates.

- If rates are going to be higher for longer, then the math suggests lower p/e multiples for stocks.

- Mortgage rates hit a 20-year high, 7.09%.

SCOREBOARD

Week Ending 8/11/2023

MARKET RECAP

Fitch downgraded US debt to AA+ from AAA a couple of weeks back. Fitch said the downgrade was due to an “erosion of governance” in the US compared to other top-tier economies over the last two decades. The Biden administration and many “experts” said the downgrade was undeserved and nonsense. Treasury Secretary Yellen said, “The change by Fitch Ratings announced today is arbitrary and based on outdated data.” But in all seriousness, who can argue with the downgrade?

Look what is going on in this country:

- For the first time in our history, we did not have a peaceful transfer of power after the 2020 election.

- The last President has been indicted multiple times and still insists the last election was stolen, and many people actually believe him.

- We have gone to the brink several times when renewing the debt limit.

- Trump added $6.7 trillion in debt from fiscal year 2017 to fiscal year 2020, an increase in the national debt of 33% in four years. At the end of fiscal year 2020, the national debt was $26.9 trillion.

- Under Biden, in January of 2023, the national debt hit $31.4 trillion.

- The cost of refinancing the debt at higher interest rates is going to compound the problem.

- Spending is just out of control, and hardly anyone cares.

So the downgrade was well deserved and should probably have been deeper.

SCOREBOARD

July Recap

July 2023: Market Basking in Summer Sun, But Whispers of Autumn Chill the Air

July 2023 brought continued sunshine to financial markets, extending the gains of June, but whispers of cooler autumn winds started to ruffle investor confidence. Here’s a closer look at the key themes:

Equity Market Resilience:

- Major indices climbed for the fifth consecutive month, defying some earlier worries about a second-quarter earnings recession.

- The S&P 500 rose 3.2%, marking its longest sustained rally since August 2021. The Dow Jones climbed 3.4%, and the Nasdaq Composite gained 4.05%.

- Small-cap and micro-cap stocks outperformed mega-caps, reversing the recent trend.

Earnings Beat and Economic Data Uptick:

- Corporate earnings largely beat expectations, with the average EPS surpassing forecasts by 5.7%.

- Economic data was generally positive, with stronger-than-expected GDP growth and job numbers.

- Lower inflation in several developed markets, including the US, boosted optimism for a soft landing scenario despite the Fed’s continued rate hikes.

Shifting Risk Appetite:

- Despite positive numbers, some investor groups turned cautious. Bearish institutional investors started capitulating, indicating potential waning enthusiasm for equities.

- Fixed-income markets saw a modest decline in government bonds, while corporate bonds outperformed.

Sector and Regional Differences:

- Energy was the best-performing sector, benefiting from improved demand and supply constraints.

- Consumer discretionary stocks also did well, fueled by positive economic data and earnings reports.

- Foreign developed equity markets slightly outperformed the US in July, with the MSCI EAFE leading the S&P 500. Emerging markets surged almost 6.3%, showcasing their strong comeback after previous slumps.

Other Notable Events:

- The Federal Reserve raised rates by another 25 bps, bringing the benchmark rate to 5.25-5.50%, and hinted at slowing the pace of future hikes.

- The US Treasury yield on the 10-year note briefly topped 4.0% but ended July at 3.954%.

- Geopolitical tensions remained elevated, with the war in Ukraine and US-China relations presenting uncertainties.

Overall, July 2023 was a positive month for financial markets, but the optimism was tempered by concerns about future Fed actions and potential headwinds in the second half of the year. The upcoming months will be crucial in determining whether the summer rally can hold its heat or if the whispers of autumn chills become a reality.

Week Ending 7/28/2023

Week Ending 7/21/2023

Week Ending 7/14/2023

MARKET RECAP

It was another big week for stocks as US markets advanced by 2.71% and a super strong 3.91% outside the US. Bonds were up 1.46% as interest fell on a good inflation report.

The market appears to be broadening out, the equal-weighted S&P 500 has doubled the S&P 500 performance over the last six weeks, 6% v 3%. The S&P 500 trades at 18.9x earnings, but when you back out the seven leaders (that trade at 40x), the index trades at 15x. Meanwhile, quarterly earnings are expected to drop for the third quarter.

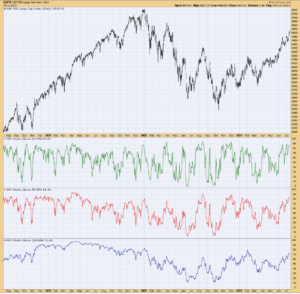

The market appears overbought. 83% of S&P 500 stocks are above their 20-day exponential moving average, 82% are above the 50-day, and 71% are above the 200 day. Two of the last times stocks were at similar metrics, greater than 80/80/70, led to sell-offs. From February 1, 2023, to March 13, the market fell by 6.4%. Prior to that, the other time was at the end of 2021, which turned out to be the last peak of the S&P 500. The market would fall by about 25% over the next ten months.

MARKET RECAP

Week Ending 7/7/2023

MARKET RECAP

After a big June where US stocks advanced by 6.73%, stocks were flat this week, +0.01%, while international markets fell slightly, down by 0.36%. Bond took a big loss of 0.96% on higher interest rates. The yield on the 1-year treasury was up by 24 basis points.

The market no longer anticipates a drop in interest rates this year and is counting on a rate increase at the next meeting in late July. Despite falling just shy of the consensus for nonfarm payrolls, the payroll report that came out this week still reflected a solid labor market, thereby putting to rest the chance for a near-term pause in interest rate increases. Payrolls increased by 209,000; the estimate was 230,000. It was the first miss after a 14-month winning streak. The two prior months were revised down by 110,000. The workweek was up to 34.4 hours from 34.3 in May, and average hourly earnings were up by 0.4%. The unemployment rate fell to 3.6% from 3.7%.

SCOREBOARD