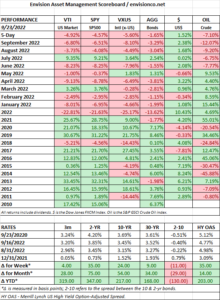

SCOREBOARD

Week Ending 10/14/2022

Week Ending 10/7/2022

MARKET RECAP

Stocks managed to advance by 1.63% for the week. The market was strong at the beginning of the week on another hope that the Fed will pivot sooner rather than later, but as that became apparent that was more hope than real, the market fell hard at the end of the week.

Employers added 263,000 jobs in September, less than the 315,000 added in August and lower than the six-month average of 400,000, but more than the consensus estimate. The unemployment rate fell to 3.5% from 3.7%, matching a half-century low. The labor force participation rate declined. The stronger than expected report sparked another sell-off in the markets, worried that the slowdown in forthcoming interest rate increases in now further away. The S&P dropped by 2.8% and the Nasdaq fell by 3.8%.

Cracks continue to appear in the economy. AMD, Samsung, and Micron Technology have all issued weak forecasts.

SCOREBOARD

Week Ending 9/30/2022

Week Ending 9/23/2022

MARKET RECAP

Financial markets hit new 2022 lows and oil dropped by 5.7% on Friday to close out the week. Oil is now down 36% from its June high. Over the last two weeks, the S&P 500 has fallen by 9.2% and the Nasdaq by more than 10%. The 2-year treasury yield closed at 4.22%, the highest level in over a decade. The composite PMI in the US was in contractionary territory at 49.3, but that was up from 44.6 in August.

A Eurozone recession is pretty much a certainty now and the odds for a US recession seem to be rising by the day. And to make matters worse, Putin has doubled down on his so far losing strategy in Ukraine and called up 300,000 reservists and threatened nuclear strikes.

SCOREBOARD

Week Ending 9/16/2022

MARKET RECAP

US stocks fell by 4.80% and bonds were off by 0.95%. The 2-year Treasury yield increased by 29 basis points. International stocks dropped by 3.30%.

On Tuesday, the Bureau of Labor Statistics announced that CPI had increased by 8.3% since last year, higher than what was anticipated. The Core CPA, which excludes energy and food, was up by 6.3% compared to 5.9% in June and July, indicating that price pressures remain intense. The S&P fell by 4.3% after the news and the 10-year treasury yield increased to 3.42% from 3.297%. According to Ryan Sweet, senior director of economic research at Moody’s Analytics, the average household is spending $460 more each month to buy the same basket of goods and services as last year.

Markets are now anticipating a fed-funds rate of about 4.25% in December, implying 75 basis point increases in September and November, and then another 25 basis points in December. The terminal rate is anticipated to be 4.45% in April.

FedEx announced weak, very weak, preliminary earnings due to weak demand. The stock fell by 22%. Ray Dalio of Bridgewater writes that a 4.5% fed-funds rate could mean a 20% drop in equity prices.

SCOREBOARD

Week Ending 9/9/2022

Week Ending 9/2/2022

MARKET RECAP

US stocks fell by 3.5% for the week and were down by 3.73% for August. International stocks dropped by 4.49% and bonds took a 3.04% hit. Oil dropped by 9.20% and the dollar increased by 1.68% for the month.

Stocks are currently selling at 17.4x 2022 estimates for the S&P 500 and 16.1x 2023 numbers. The 2023 numbers peaked on about June 17 and have declined by about 3.33% since then. Much less than what was expected, but there is probably more to come.

Employment increased by 315,000 jobs in August, down from 526,000 in July. The increase is still considered a solid absolute number but indicates some cooling in the job market. The unemployment rose to 3.7%, up from 3.5%, as more workers entered the labor force. Those seeking work are now at 62.4% compared to 62.1% in July. Average hourly earnings were 5.2% higher than one year ago, consistent with the prior month. And month over month, the increase was 0.3%.

The Group of Seven agreed to an oil price cap for Russian oil, and in turn, Russia suspended natural-gas flows to Europe, although they blamed the stoppage on repairs. The oil price cap relies effectively relies on insurance to enforce its terms. In order to get insurance, buyers would have to observe the price limit. Almost all insurance for these types of shipments runs through G7 countries.

SCOREBOARD

Week Ending 8/28/2022

MARKET RECAP

The market’s wishful thinking that the Fed would step off the brakes earlier rather than later officially came to a close on Friday in Jackson Hole when Fed Chair Powell said that “We will keep at it until we are confident the job is done.” Powell made clear that there will be no pivot in strategy anytime soon and that the end goal is to get inflation back to the 2%. Fed officials have made projections that rates would need to get to almost 4% by the end of next year for that to happen. Stock plunged, with the Dow dropping by more than 1,000 points. The S&P 500 dropped by 3.4% and the Nasdaq by 3.9%.

For the week, the overall US market was down by 3.79% and bonds fell by 0.37%. Year-to-date, US stocks are down by 15% and international markets are off by 17.3%, bonds are in the negative by 9.88%.

Powell wants to avoid the mistakes of the 1970s and early 80s when the Fed didn’t follow through on interest rate increases and inflation remained a persistent problem until Paul Volker has to raise rates to very high level to break the cycle.

SCOREBOARD

Week Ending 8/19/2022

MARKET RECAP

The stock market’s four-week winning streak came to a close as US equities fell by 1.47%. The cheery optimism that the Fed may apply the brakes to aggressive interest rate hikes was notched down a bit based on the release of the minutes from the Fed’s July meeting and comments from central-bank officials.

Bed, Bath & Beyond showed that even after the big sell-off in 2022, speculators were quick to go back to their old ways, as the stock was up by 122% since July 1 (despite any positive news), and then fell by 41% on Friday when it was revealed that billionaire Investor Ryan Cohen sold off his entire investment.

SCOREBOARD