A pairs trade is a market neutral trade where an investor goes long one stock (or etf, cef, etc) and short another, usually when the historical relationship between the two is outside the mean, with the objective of closing out the position when the relationship reverts to the mean.

As an example, let’s look at two closed end funds, Western Asset Worldwide Income Fund (SBW) and the Legg Mason Partners Income Fund – Western Asset Emerging Markets Debt Portfolio (ESD).

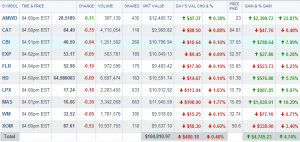

SBW and ESD share are similar. For starters, both are managed by Western Asset. Below are some pertinent statistics as of 12/13/12.

|

ESD |

SBW |

| Annualized Distribution Rate on NAV |

6.47% |

6.28% |

| Total Return on NAV |

16.23% |

15.46% |

| Average Portfolio Coupon |

7.06% |

7.11% |

| Total expense ratio |

1.02% |

1.29% |

There is not a perfect correlation between the two but they are close.

Closed end funds do not necessarily sell at net asset value (NAV). They can sell at a premium or discount. Taking the current price and the NAV as of yesterday, here are the discounts the two CEFs are selling at.

Going back about three years and looking at month end data, the average spread between the two is about 0.80%.

A trader/investor can go short the ESD and long the SBW and wait for the spread to narrow and close the position. Assuming the NAVs stay in line with each other, the difference between the closing spread and the opening spread would represent profit, less trading costs and slippage.

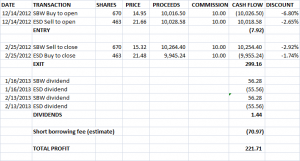

As an example, buy 670 shares of SBW at $14.95. Figure a $10 commission (and you can get less), would be an outlay of about $10,026.50. Short 463 shares of ESD at $21.66 less the $10 commission would bring in $10.018.58. The net outflow is $7.92.

Let’s wait and see if the spread narrows to 1.65% and let’s assume the NAV for the two CEFs does not change and let’s assume the price of ESD does not change. These are all big assumptions but this is for illustration purposes. This means that SBW would now be selling at $15.35, or at a discount of 4.30% (15.35/16.04). To close the position sell 670 shares of SBW for $15.35 less commission for $10,274.50 and buy to close the 463 shares of ESD at $21.66 plus the commission for $10,038.58. The net inflow is $235.92.

| TRANSACTION |

SHARES |

PRICE |

PROCEEDS |

COMMISSION |

NET FLOW |

DISCOUNT |

| SBW Buy to open |

670 |

14.95 |

10,016.50 |

10 |

(10,026.50) |

-6.80% |

| ESD Sell to open |

463 |

21.66 |

10,028.58 |

10 |

10,018.58 |

-2.65% |

| SBW Sell to close |

670 |

15.35 |

10,284.50 |

10 |

10,274.50 |

-4.30% |

| ESD Buy to close |

463 |

21.66 |

10,028.58 |

10 |

(10,038.58) |

-2.65% |

| Profit (Loss) |

|

|

|

|

228.00 |

|

Combined, the profit on this transaction is $228. Not bad for laying out about $8 (understand though that the risk is theoretically infinite). There can be big risks in this trade. The price and/or NAV of the long position in SBW could decline and the price and/or NAV of the short position in ESD could increase, resulting in a loss and maybe a big loss. There are also margin requirements to consider, as well as liquidity, and the impact of taxes and dividends. But this is an example of a possible pairs trade using CEFs.