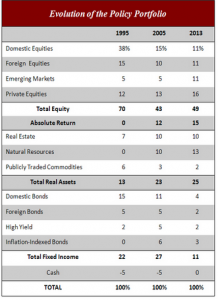

Here is how the Harvard Endowment has evolved in recent years:

Category Archives: Uncategorized

Barrons 1/20/14

NOTES FROM BARRONS

______________________________________

Follow-Up: Gamestop (GME) got hit hard last week on disappointing sales. Good entry opportunity, now at 10x ’14 eps. $5 per cash and no debt, 50% market share. Wedbush analyst Michael Pachter has a $60 target, GME has “at least 10 years” left in its core business.

______________________________________

The Eco-Oil Producer – Denbury Resources (DNR) – specializes in getting out the last 60% of oil from a well using carbon-dioxide flooding. DNR is second largest player in this space. Yield should be 3% in 2015. Price = $16.46; 4.5x FCF, industry average is 6.8. Closing the gap will get price to $20 not including dividend. Greenspring fund is an investor. 36% discount to NAV, peers trade at a 20% discount.

______________________________________

The Valuation Gap at Gap – shares could climb 30%. Price = $37.30, company has set itself up for difficult sales comparisons. Same store sales were flat in December and +2% in November. 12.6x ’14. Has been buying back stock.

______________________________________

Sizing up Small-Caps – Dean Foods (DF) – 1.6% yield, $300m stock buyback program. 5.7x ’14 EBITDA and 6% FCF yield.

______________________________________

Trouble on the Menu – Restaurant stocks could be in for trouble, trading at 21x. During expansions, home purchases rise and spending moves towards durables and away from restaurants. Stronger economy will increase birth rate. A new child reduces a family’s restaurant spending by 10%. Low income jobs are replacing middle income jobs. MCD, BKW, DRI might have trouble.

______________________________________

Ride Out the Mortgage Reit Rout – a guessing game as to what directions prices will move. LNY and AGNC are at 80% of book value. Rising rates at the long end of the curve could put pressure on book value. In a webcast last week, Jeff Gundlach said “I have no problem owning Annaly at this price; I just don’t think the price is going to go up in the near term.” But with the dividend, that could still mean a 10% return this year.

______________________________________

Roundtable – “Optimists expect the global economy to pick up, bonds to tick up and stocks to mosey higher, notwithstanding the errant hiccup.” The pessimists “see crippled economies here and abroad, rotten government policies, and a sell off in stocks that could rekindle fears of yes, systemic risk.”

Bill Gross does not expect rising yields and absent higher inflation and a change in policy, bond markets should be stable. Abbey Cohen thinks they could drift higher. According to Cohen, GS is forecasting GDP growth of 3.3%. Zulauf thinks world economy will disappoint, US will be top economy. Faber says the Fed will bankrupt the world. Faber said “The Fed acted correctly to save the financial system during the financial crisis, which it created with easy-money policies in the late 1990s and early 2000s. But Ms. Yellen could be sitting on a barrel of gunpowder, pouring gasoline on top of it, and lighting a cigarette, and she wouldn’t know the danger of bubble creation.” Faber thinks sometime this year there will be a big tumble, like in 1987 and the long bond will rally. Fred Hickey says that the markets dropped 13% at end of QE1 and 17.5% at end of QE2, the market is set to blow up.

Scott Black and Cohen expect SP earnings of $116. If p/e remains steady that gets you to 1900, but if PE expands to 18-20x, which could be reasonable given core inflation, target would be 2088.

Some of Felix Zulauf’s picks, +TLT, +GDX, -EWH, -TUR.

Characteristics of Value Traps

Jae Jun’s summary of a Jim Chanos presentation:

http://www.valuewalk.com/2014/01/characteristics-of-value-stocks-and-value-traps/

Barron’s 1/13/14

Where to find yield? In order of appeal, (1) high-dividend stocks, (2) municipal bonds, (3) REITs, (4) telecom stocks, (5) convertibles, (6) electric utilities, (7) preferreds, (8) junk bonds, (9) MLPs and (10) treasuries.

—————————

Cisco (CSC) – could be good for 20%.

—————————

Magna (MGA) – controls 11.3% of US auto-parts industry. 10.6 x ’14 EPS, debt free balance sheet, cash and a buy-back program. Scott Black says a valuation of 14x his firm’s estimate of $7.60 a share in ’14 puts the shares at $106 (they are about $83 today). Yield is 1.5% today.

—————————

Interview with Robert Ewing of Putnam Investments

JPM – cheapest bank by most metrics. Single-digit forward-earnings multiple, and 1.5x book value. Maintaining or gaining share in 14 of 16 segments.

BAC – 1.2x tangible book value. Can generate 12-13% return on equity over the long term. Will benefit from rising interest rates.

Both companies should trade at 2x bv and in low double digit multiples.

Also likes RDSA.

Beneish M Score

Here is an article summarizing the Beneish M score:

http://www.valuewalk.com/2014/01/using-beneish-m-score-to-detect-earnings-manipulation/?utm_source=mailchimp&utm_medium=email&utm_campaign=EMAIL_DAILY

JPM Guide to the Markets

We reviewed the JPM Guide to the Markets which is a quarterly publication put out by JP Morgan that is filled with all kinds of really good charts. Here are some takeaways and charts of interest.

1. Chart 5 – Large blend, large growth and medium growth (style boxes) are all less than 100% when measuring current p/e as a percent of 20-year average p/e.

2. Chart 6 – returns and valuations by sector.

3. Chart 7 – SP500 earnings yield remains above the Baa yield.

4. Chart 8 – Profit margins are at all time records while total leverage is low.

5. Chart 9 – Year over year SP500 EPS growth as of Q3 was made up of better margins (8%), revenue (3.3%) and share count (0.6%).

6. Chart 10 – Year over year total return was made up of multiple expansion (18.4%), earnings (11.2%) and dividends (2.8%).

7. Chart 11- forward PE of 15.4 is just above the 14.9 average. There is a positive relationship between consumer sentiment and the forward p/e and the estimate impact of a 10 point rise in sentiment is +2 p/e multiple.

8. Chart 12 – When 10-year treasury yields are below 5%, rising rates are generally associated with rising stock prices. A scatter plot shows negative returns when rates start moving above 5%. But sectors that offer a higher yield will be more sensitive to interest rates moving higher.

9. Chart 13 – Corporate cash is close to highs.

10. Chart 14 – P/E ratios and return over a 1-year period are not that correlated. In other words, returns can be good or bad. But over a 5-year period, there is tighter correlation.

11. Chart 15 – real earnings yield is about 4% now, average is 2.6%, but there is often more room for the markets to advance even after hitting average.

12. Chart 16 – 26 of 33 years since 1980 have been positive. Chart 16 shows the intra-year declines for each year.

13. Chart 17 – Equity correlations increase with increases in volatility. As volatility begins to decline from peaks, stocks should outperform.

14. Chart 19 – Pullbacks in spending in light vehicle sales, manufacturing and trade inventories, housing starts and real capital goods orders often lead to recessions. All have been increasing except for manufacturing and trade inventories, which has been flat.

15. Chart 20 – Still an affordable time to buy a home.

16. Chart 21 – there has been significant deleveraging of the consumer balance sheet.

17. Chart 22 – Core CPI has been much less than the 50-yr average of 4.1% in recent years (in November it was 1.7%).

18. Chart 27 – reduced US reliance on foreign oil in future years.

19. Chart 28 – if you invest at the turning points of low confidence levels your return would be very good.

20. Chart 30 – nominal and real 10-year treasury yields since 1958.

21. Chart 31 – High-yield and floating rate bonds have a negative correlation to the 10-year treasury. So do convertibles and ABS.

22. Chart 33 – Money is being held in excess reserves which means it is not multiplying through the economy, and that is why there has not big a big inflation impact from all of the QE programs, at least so far.

23. Chart 35 – there has been a huge increase in flows into high yield bonds.

24. Chart 37 – Developed market and emerging market high yield bonds have attractive yield, negative correlation to 10-year US Treasuries and produced positive returns in 2013.

25. Chart 39 – looking at sources of global equity returns, multiple expansion was the big driver across the board except in emerging markets, where multiples declined as did earnings.

26. Chart 40 – countries way short of their 2007 peak are Italy, Russia, Spain and China.

27. Chart 41 – EAFE index is still well off its previous 2007 peak. P/E is 13.3 and yield is 2.9%.

28. Chart 42 – Emerging markets have much higher projected growth compared to developed markets.

29. Chart 43 – Manufacturing momentum

30. Chart 44 – how important are exports to specific countries. Exports are a % of GDP for the US was 9.5% which is less than other countries.

31. Chart 45 – Urbanization ratios, India and China lag by large amounts. Another chart shows that emerging markets consumption is on the increase and now has a bigger share than the US of global consumption.

32. Chart 46 – charts include value of public companies as a % of GDP. Only the UK and the US is greater than 100%.

33. Chart 47 – emerging market sensitivity to capital flows and currency performance.

34. Chart 48 – Sovereign debt stresses – emerging markets have lower debt, better growth than developed markets but higher borrowing costs.

35. Chart 49 – global monetary policy. Emerging markets still offering real rate returns.

36. Chart 54 – Global equity markets. The US makes about half of the MSCI All Country World Index but only about 19% of global GDP.

37. Chart 56 – Global equity valuations in developed markets. Shows forward p/e’s compared to 10-year averages.

38. Chart 57 – Global equity valuations for emerging markets. Russia has a forward p/e of 4.8 versus a 7.9 10-year average.

39 Chart 58 – asset class returns.

40. Chart 59 – Correlations and volatility between different asset classes.

41. Chart 60 – alternative asset class returns.

42. Chart 61 – mutual fund flows

43. Chart 62 – equity dividend yield from major world markets and REIT yields.

44. Chart 63 – global commodities –

45. Chart 64 – historical returns by holding period for stocks, bonds and a 50/50 portfolio.

46. Chart 65 – returns and standard deviations for a traditional and a portfolio with much greater diversification.

47. Chart 66 – cash accounts.

48. Chart 67 – corporate defined benefit plans and endowments.

links – https://www.jpmorganfunds.com/cm/Satellite?UserFriendlyURL=diguidetomarkets&pagename=jpmfVanityWrapper&vanity=diguidetomarkets

Barron’s 12/30/13

Bill Carache from Nomura raised price targets on Visa to $264 and MasterCard to $935. Earnings can increase by 15% annually for next 5 years.

—————–

Coke (KO) could rise 20%+ over next year. Recipe – turn 3 to 4% yearly volume growth into 5-6% revenue growth and EPS growth in high single digits. Recently fallen short. Big picture per Jonathan Feeney of Janney Capital Markets is 700 million people will join middle class by 2020 leading to a double in soft drink sales and the infrastructure is already in place.

—————–

Fayez Sarofim, Houston based money manager since 1958 – buy high quality stocks and hold them forever. Too much trading is a destroyer of wealth. Top 10 holdings are PM, AAPL, XOM, KO, CVX, NSRGY, JNJ, MCD, COP and IBM.

—————–

A simple timing model

John Hussman wrote about a simple market timing model in his May 6, 2013 weekly market comment in which he shows how the SP500 performed under a few conditions.

The article can be found at this link:

http://www.hussmanfunds.com/wmc/wmc130506.htm

The timing approach uses a 39-week smoothed moving average. This approximates 10 months or 200 days. Excess return is defined as the market return in excess of T-bills. When the SPX was greater than this average, the excess annual return was 9.6% and when it was less than this average the excess return was 0.3%.

OVOB stands for overvalued, over bullish. That is defined as a Shiller P/E (PE) greater than 18 and advisory sentiment reading that is greater than 47% bulls and less than 27% bears at any point over the most recent 4-week period. Hussman is using numbers based on Investors Intelligence and imputed numbers prior to the 1960s. Under these conditions, when the SPX was greater than the moving average (MA) the excess return was -4.2% (annualized) and when it was less than the MA the excess return was -4.6%.

When the SPX was greater than the MA and the PE less than 18, the return was 15.1% but when the PE was greater than 18 the return fell to 4.3%. Now look at the impact of investor sentiment. Under these latter conditions (SPX>MA and PE>18) when the market is not overly bullish the excess return is 11.7% but when conditions are overly bullish the excess return is -3.3%.

Finally, when the SPX is less than the moving average and the PE is less than 18, the excess return is 1.2% but when the PE is greater than 18, the excess return is -1.9%.

So where is the market now. SPX is above the moving average, and the Schiller PE is greater than 18 (it is 25.4 based on a calculation at GuruFocus). Investors Intelligence is reporting 67.2% bullish. The PE has been above 18 all year and so has the moving average and yet the market has had strong gains. So as we all know nothing works all the time as this year has proven in this particular example.

All of the above returns are summarized below:

| Condition | Annual Excess Return | Sharpe Ratio | Frequency |

| SPX > MA | 9.6% | 0.78 | 70.3% |

| SPX < MA | 0.3% | 0.01 | 29.7% |

| OVOB | -4.6% | -0.33 | 19.1% |

| SPX > MA, OVOB | -4.2% | -0.32 | 17.0% |

| SPX > MA, PE < 18 | 15.1% | 1.18 | 35.6% |

| SPX > MA, PE > 18 | 4.3% | 0.36 | 34.8% |

| SPX > MA, PE > 18, NO OVOB | 11.7% | 1.04 | 18.3% |

| SPX > MA, PE > 18, OVOB | -3.3% | -0.26 | 16.5% |

| SPX < MA, PE < 18 | 1.2% | 0.06 | 20.1% |

| SPX < MA, PE > 18 | -1.9% | -0.10 | 9.5% |

Barron’s 12/23/13

American Tower (AMT)

Company leases antenna space on cell carriers and is a beneficiary of wireless firms efforts to improve service. Sales should be up 20% and net income up 46% in 2014. Trades at 18x next year’s AFFO. Yield is 1.5%. AMT was subject to a bearish report by Muddy Waters in July.

—————————-

Ambac (AMBC)

Improving markets should help it pay back insurance claims with about $1.6b remaining. Market value is $1.1b. Price = $21 and could advance 50% or more in a year or so. This is speculative and it insures $2.5b of Puerto Rican debt.

—————————-

PVH – shares can rise 20% or more next year.

—————————-

A.M Castle (CAS) – small cap $13.64. Will lose money this year. Has an activist investor. Jeffries see the business improving and a $20 price target.

—————————-

Closed-end funds are selling at historic discounts. Current discounts provide a margin of safety against rising rates. Muni’s offer some good opportunity.

Bitcoin down about 50%

Bitcoin hit $455 today down from around $1,000 a few weeks ago. See our Gary North quote from November 30.

Link to Marketwatch article: http://blogs.marketwatch.com/thetell/2013/12/18/bitcoin-spirals-down-as-china-exchange-halts-yuan-deposits/