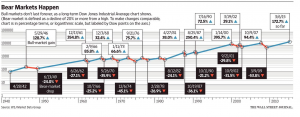

Here is a good graphic on bear markets:

Category Archives: Uncategorized

Market Recap 06.06.2015

For the week, the VTI fell by 0.367%, the SPY 0.65%, the VT by 1.06% and the AGG by 1.47%. The equity markets have fallen two weeks in a row now but it hasn’t been much of a fall. The VTI hit a high on May 21 of 110.51 and is now down 1.45%, the SPY is down 1.75% over that same period.

The situation in Greece is still up in the air. Some payments were delayed to creditors last week.

Fears of a rate hike continue to spook the market impacting interest sensitive stocks much harder. REITs have taken a beating, the VNQ is down 3.67% since May 21 and are down 10.64% since March 23. There are some quality REITs now yielding 5% or better and some around 6%. Long bonds resumed their downtrend, the TLT (20-Year Plus Treasury bond ETF) was down 4.16% for the week. The five-year yield has jumped 26 basis points, the 10-year 29 basis points, and the 3-year yield was up 23 basis points since the end of May pushing bond prices lower.

Anything with yield is getting punished, but there is starting to be some value as prices decline in certain sectors. In addition to some of the traditional REITS, some of the mortgage REITS are selling at big discounts to book value. Companies like Capstead (CMO) invest in short-term adjustable rate mortgages that should not be that exposed to interest rate risk.

Then there are companies that should benefit by rising rates. MET is up almost 7% since April 30. Many banks have been doing well. JPM is up 6.6% and C is up 5.58% in that time frame.

Assuming a September rate increase, Jeremy Siegel thinks the market can do well in Q4 when the market figures out that the world won’t end (http://www.cnbc.com/id/102725157). And at a few companies, like GM, GE and CVX, there has been some good insider buying of late.

The economic reports this week were strong. Auto sales hit an annual rate of 17.71 million which is a new high. The employment numbers surprised to the upside and unit labor costs were higher, a small signal of possibly higher inflation down the road and lower profit margins.

Market Recap 05.23.2015

Markets were mixed this week as the SPY and the VTI advanced by 0.26% and 0.33% but the VT and the AGG fell by 0.22% and 0.37%. We wrote our last market recap on May 2 and since then the SPY moved up by 1.08% but the AGG fell by 0.50%.

Janet Yellen said on May 6 that “Equity market values at this point generally are quite high…there are potential dangers there.” That comment coincided with the low, at least so far, for the month of May.

According to Bespoke, the Q1 earnings season recorded 60% of companies with an earnings beat and 50% with a revenue beat. The earnings beat was in line with historical numbers but the revenue beat was low. Earnings guidance was -2.9%, about in line with past estimates.

What has gotten the market more concerned is the change in interest rates. The 2/10 spread started the year at 1.50 and is currently 1.57, but the 10/30 spread has opened up from 0.58 to 0.78. The 2/30 spread started the year at 2.08 and is now 2.35, so the curve has steepened on the long end, thus contributing to the year-to-date fall in the AGG.

Ultimately, a price of an asset is a function of future cash flows divided by a discount rate. If rates are headed higher, all other things equal, prices of assets will come down. The market might have already priced in some future increases, but the risk would be that rates increase faster and higher than anticipated. The Fed seems very hesitant to rush any kind of increase.

Higher interest rates have helped floating rate funds. A good gauge in sentiment is the changing discount/premium in closed-end funds. The Apollo Senior Floating Rate (AFT), a fund that we have held in some accounts for a while, now sells at 1.08% discount but started the year at a 9.27% discount to NAV. Meanwhile, closed-end funds that own municipals continue to sell at steep discounts. The MFS Municipal Income (MFM), also a fund that we own in some accounts, is selling at an 11.52% discount from NAV. It started the year at a 9.91% discount. The current distribution rate is 6.14%, let’s assume an investor has a 28% marginal tax rate, that would be a tax-equivalent yield of 8.53%.

We are thinking about gold. Last week in Barron’s Laurence Fink, head of BlackRock said that “gold has lost its luster” as a historic store of wealth. That seems to be the consensus about the metal. Add in the fact that the VIX hit a 2015 low on Friday and maybe that is a signal.

It’s All Relative

While valuation metrics point to a very highly valued stock market, you can’t look at those metrics in a vacuum. You have to look at alternative investment opportunities including the level of interest rates. Just this week we heard from Warren Buffet and Leon Cooperman with their take on valuation.

Warren Buffet said (http://www.cnbc.com/id/102644439), “the market, based on normal interest rates, is on the high side of valuation, not dangerously high but on the high side of valuation. On the other hand, if these interest rates were to continue for ten years, stocks would be extremely cheap now.”

Leon Cooperman (http://video.cnbc.com/gallery/?video=3000376412&play=1) said “I think the market is in a zone of fair to full valuation…the stock market is at about 16-1/2 times earnings and it seems about right.”

Ira Sohn Conference

Today was the Ira Sohn Conference, where some of the biggest hedge fund managers get together to pitch their best ideas and help raise money to fight pediatric cancer.

Leon Cooperman said “I think the bond market is overvalued, but the stock market is about 16 times earnings and [it] seems about right ” This echoed comments by Warren Buffet who said earlier in the day that he would short the bond market if he could. David Tepper also said there is a chance that treasury’s could fall hard.

David Einhorn went after Pioneer Natural Resources (PXD) laying out a strong argument that PXD simply does not make economic sense.

Jeffrey Gundlach says that the low in bond yields has already happened.

Market Recap 05.02.2015

The market was down 1.5% going into Friday, but a rally on the final day of the week left the SPY off only 0.44%, VTI was off 0.87%, VT minus 0.44% and the AGG declined 0.85%.

The GDP number came in at 0.2% which was worse than the already weak expectations of 1%. Last week we wrote about big price advances by NFLX and AMZN, this week the big moves were to the downside as LNKD fell 21% and TWTR down 26%.

361 companies have reported and according to Zacks, profits are up about 4.7% but revenue is down 4.1%.

Market Recap 4.25.2015

The market had a good week as the SPY was up 1.78%, VTI +1.64%, VT +1.89% and AGG -.15%. But it was the NASDAQ that really powered the market, the Qs (QQQ) was up 4.27% on the week helped by MSFT, AMZN and GOOG.

Economic data was not in sync with the positive market. The Chicago Fed National Activity Index missed by 1/2 point. the CFNAI measures overall economic activity. It was the worst reading since June of 2014 and the 3-month average of -.27 is now the worst since October of 2012.

Likewise, the durable goods report, ex-transportation, also was 1/2 point short of consensus.

400 companies reported earnings and 64% beat earnings estimates but only 42% beat the revenue number. Earnings guidance is running at about a -3.5% so far this quarter, but that is an improvement on last quarter.

None of the above seems to matter. In a world with zero or negative interest rates there is not much alternative. The SPY and the VTI are very close to all-time highs, the Qs are in new high territory as is VT.

Some of the former high flyers are back in business. AMZN closed the week up 18.5%. Since January 20th, AMXN is up 53.78% and has a forward p/e of about 100. Over the last two weeks NFLX is up 22.84% and is up 63.46% on the year. NFLX has a forward p/e of 125.

Barry Ritholtz talks EV/EBITDA

Barry Ritholtz, from The Big Picture, points out today on Bloomberg that Enterprise Value / EBITDA has the best track record of forecasting forward markets. Looking market wide EV/EBITDA shows that the market is about fairly valued so future gains should be about average, in the 8 to 10% area. This is in contrast to other ratio’s which show an overvalued market.

In regards to CAPE, the metric misses a couple of key points. ROE for technology companies are completely different than old line business. They simply do not require the investment that traditional old-line businesses did. Second, the cost of being an investor today is a fraction of what it used to be.

Market Recap 04.11.2015

When we left off last week, the market was closed on Friday, April 3 for the Good Friday holiday, but employment numbers were released and it was a disaster. The futures took a big hit and it was expected that the market would have a tough Monday. Well I guess over the weekend it was decided that bad economic news is good stock market news, as it so often is (in the “market’s” view), and the market opened slightly down on Monday but then finished strong and was up for the day. Tuesday was a small decline and the rest of the week was up. In sum, it was a good week for the equity markets.

The SPY was up 1.74%, the VTI was up 1.61%, VT was up 2.00% and the AGG fell by 0.22%.

Earnings week kicked off and 24 companies reported. 20 of the 24 topped expectations. 36 SP500 companies report this week coming up. As a counterweight to the poor employment report described above, on Thursday, claims for first time unemployment benefits fell to 282,000. That is the lowest number since June 2000. GE added to the up move on Friday, announcing it will divest of most of its GE Capital finance unit over the next couple of years. Proceeds, expected to be about $90b, would be used for buybacks. GE was up 14% on the week.

Market Recap 04.04.2015

The market was closed on Friday for the holiday and that kept the indexes in the black for the week. The SPY was up 0.34%, VTI +0.49%, VT +0.71% and AGG +0.41% (dividend adjusted). However, a weak payroll report came out Friday morning and that pushed the e-mini futures down 0.62% on the week. So the regular markets were essentially saved by the Good Friday holiday but will most likely start Monday lower.

Non-farm payrolls increased by only 126,000. That was almost half of the expected increase of 245,000. So it was a huge miss and payroll numbers were also revised down from the previous two months. The unemployment rate remained steady at 5.5%. Economic reports have been to the weaker side of late, but many consider this a result of an extremely cold winter and the impact of the port slowdown in California. Still, there now has to be some consideration that there is something to the poor numbers and the strong growth we saw to close 2014 was the aberration. The slower economy can be measured by the the 10-year treasury bond yield which has dropped to 1.81% from about 2.13% at the close of the year.

Earnings season begins this week and companies are running into three headwinds. First, the fall in energy prices will have a big impact on that sector and earnings will be hit, bringing down the overall market earnings. Second, the strong US dollar will negatively impact firms that do international business, that means much of the SP500. And third, the bad weather and the port slowdown in the United States will impact many domestic businesses. Overall earnings are expected to fall 3-4% this quarter. The SPY is only off 2.62% from its March 2 high of 211.99. So we have earnings going one way (down) and the market going the other way (up). That cannot go on forever. We will see if the economy can pick up from here.