This CNBC article reviews several valuation models. There are arguments that the market is overvalued and undervalued.

Category Archives: Uncategorized

On the horizon…

It has been a tug of war between the bulls and the bears so far in September. The SPY is down 1.45% for the month although it was actually up as of this morning. But a good start ended in terrible fashion as the market fell 2.27% from open to high. Aside from China, the market is waiting on the Fed’s decision next week in regards to an interest rate hike.

Personally, I think a small 1/4 point hike is needed and would be a long term positive. We need to get the economy operating based on normal market forces, not artificially low rates. The job market appears strong enough to support such an increase, today’s JOLTS report shows more job openings and tight labor markets. The US economy is doing well. Savers have been starved by a zero rate policy. It is time for a slow (very slow) liftoff of rates.

But another obstacle that hasn’t been spoken about but is now on the near term horizon is the possibility of a government shutdown late this month. Certain politicians may grandstand and essentially force the government to close down.

Given the volatility in the market and the fears about China and the Fed hiking rates, a self-induced wound is something we could do without.

August Recap

August was a tough month as the market took a negative hit. The VTI (US Stock Market) fell 6.09% and the international markets as measured by the VT (ex-US) fell 6.68%. Even the bond market did not end positive as the AGG (aggregate bond index) dropped 0.34%. The VTI is now down 2.70% for the year.

Fear over slowing growth in Chain and worries about the Fed’s first interest rate increase was enough to do the market in. China’s growth, especially in the manufacturing sector, appears to be slipping fast. China also devalued their currency which shook the market.The Shanghai Composite fell 12.49% for the month and is now down 36.49% over the last three months.

The SPY had been trading in a range between 204.40 and 213 since February. That range cracked on between August 21 and August 25. The SPY hit its closing low for August on the 25th at 187.29. That is down 12.17% since the May 21 close of 213.50. That put the market in correction territory for the first time since 2011.

Despite the bad news on China, our best guess at this time is that it will not have a huge negative impact on the US economy. The US economy continues to move along nicely and China represents only about 1% of US GDP. The market was long overdue for a correction and now we have it. It would be unusual for the correction to turn into a full-fledged bear market without a recession on the horizon. However, this does not mean there cannot be some more pain in the equity markets.

July Recap

July was generally a good month unless you were primarily in energy. The SPY led the way up 2.21%, the overall US markets as measured by the VTI increased by 1.70%, world markets as measured by the VT were up 0.50% and the aggregate bond index, AGG, increased by 0.86%.

The energy sector (XLE) declined 7.69% and materials (XLB) were down by 5.04%. Consumer staples (XLP) advanced by 6.36%, utilities (XLU) 6.10%, and REITs (VNQ) were up 5.77%.

Greece dominated the headlines in the early part of the month and the SPY fell to 204.83 on July 8. But that low coincided with an agreement between the Euro countries and Greece and the markets took off from there. The SPY closed at 210.45 on the 31st. The market continues to trade in a range between 204.40 on the downside and about 213 on the upside. This range dates back to February.

SPX pullbacks versus the VIX and Put/Call ratio

Here is a good chart from Andy Nyquist that looks at recent pullbacks in the SPX and its relationship to the VIX and the put/call ratio.

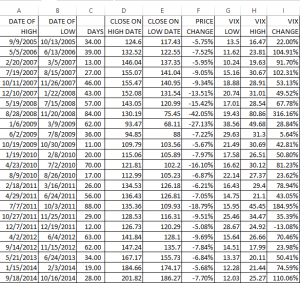

We created a similar table a while back that shows pullbacks in the SPY of 5% or more since September of 2005 and what the VIX high and low was. The idea is to see at what level “panic” has set in to mark the end of the pullback.

As of today, the last peak in the SPY was on May 21 at 213.50 and the low was on July 8 at 204.53. That is a decline of 4.2%. During that time, the VIX has risen from 12.11 to 19.97 at the close today, a rise of 65%. In our table the average rise of the VIX has been 70.8% and the average high was 30.10, but that includes 2007 and 2008. Just looking at 2012-2014 the average decline was 7.55%, the average VIX high was 22.29 and the average percentage rise in the VIX was 65.90%.

Mid-Year Update

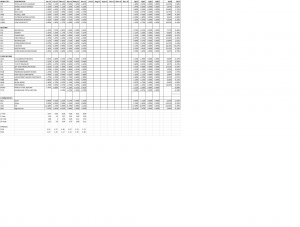

The SPY (SP500) was down 0.26% for the quarter but including dividends the index scraped out a total return of 0.22%. Year to date the SPY was up 1.11% including dividends. The VTI (overall US stock market) was up 1.88% and the VT (international markets x-US) was up 3.61%. The Dow Jones Industrial Average was down 1.14%. The AGG (aggregate bond market) fell by 1.07% year to date. All of these returns include dividends.

The market got hurt in the final two days of the quarter because of the fear of a default by Greece. The SPY fell by 1.91% the last two days. So the market dropped from a +3.07% to a +1.11% in the closing days.

Greece is the short-term catalyst over the near term and can push the market in either direction at this point.

The first-half of this year was the first time that both the Dow Jones Industrial Average and long-term Treasuries (-4.7%) fell during the first six-months of a pre-election year. Despite the fall in the final couple of days of the quarter, most sub-industries are still trending higher. The equity markets are high based on traditional valuation metrics on a historical basis, but when you factor in current interest rates, market valuations seem about right. In early May, when the market was higher than it is now, Warren Buffet said “the market, based on normal interest rates, is on the high side of valuation, not dangerously high but on the high side of valuation. On the other hand, if these interest rates were to continue for ten years, stocks would be extremely cheap now.” The SP500 has not had a correction of 10% in 914 days, the third-longest such period ever.

Aside from Greece, what has spooked the market is higher interest rates. The Fed has alluded to higher rates for what seems like years now but has been extremely cautious to make the move. June was supposed to be the first liftoff date, but that didn’t happen. So we are probably looking at September. Whenever it is, the Fed has made it clear that they will be very cautious when it comes to raising rates so we do not expect a rapid rise barring some kind of shock to the economic system.

But the fear of a rise in rates did hurt anything that pays a decent dividend in the last quarter. REITs and utilities got hammered. The Vanguard REIT ETF (VNQ) lost 10.52% for the quarter and the Utilities SPDR Fund (XLU) lost 5.84%. There are now some compelling values in both sectors and the reaction might have been overdone.

The economy continues to plod ahead on a slow but somewhat steady course. That is the case in the US and around the globe. Ex-Greece, Europe is doing well. 88% of Eurozone countries report PMI readings above 50. PMI stands for purchasing managers index and is an indicator of the economic health of the manufacturing sector. A PMI of more than 50 would represent an improvement over the previous month. Japan and India also improved while China was less than 50 but the rate of contraction has slowed there. The United States reported 53.6.

A correction is long overdue and can happen at any time, but we do not see such a correction leading to a bear market. We are cautiously optimistic on the equity markets at this time.

Tribute to Jim Grant

Here is a tribute to Jim Grant of Grant’s Interest Rate Observer. Jim recently received the 2015 Loeb Lifetime Achievement Award. Jim is a giant in financial journalism and it is a pleasure to read his publication.

https://vimeo.com/chrisderrico/review/131241569/0f1bbc32bc

Scorecard for Q2 and YTD

Grantham says we are closing in on bubble territory

Jeremy Grantham says we are 5 to 10% away from entering bubble territory. But prices can continue to go higher from there. Grantham thinks we probably have a year or two more to go, and then a big drop of 50% or so.

http://www.morningstar.com/Cover/videoCenter.aspx?id=701816

The Power of Patience

First Eagle Investment Management’s senior advisors sat down recently to share their insights on market dynamics and opportunities. This video segment features Matt McLennan, Harold Levy and Bruce Greenwald discussing the power of patient investing.

http://www.valuewalk.com/2015/06/bruce-greenwald-the-power-of-patience