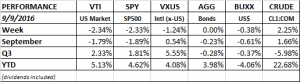

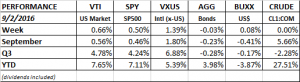

PERFORMANCE

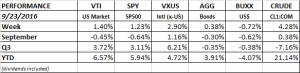

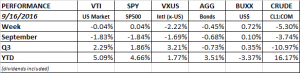

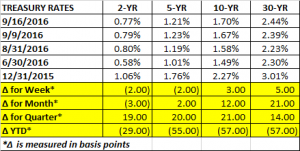

The Fed did not lift rates this week and that moved the markets higher. The US equity markets were up 1.40% and international markets were up 2.90%. The US dollar declined 0.72% and oil rallied by 4.28%. The Fed made it clear that the pace of interest rate increases would be very deliberate and carefully considered. That helped bonds, which rallied by 0.38%. However, the Fed is probably leaning towards a December increase. Assuming nothing crazy with the economy between now and then, we believe a slow and measured pace of interest rate increases would be beneficial for the economy in order to put it back into a historical balance.

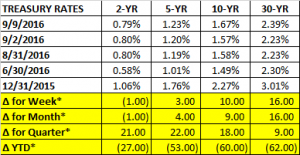

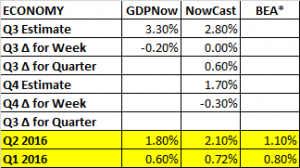

ECONOMY

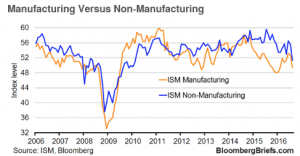

The Atlanta Fed’s GDPNow declined to 2.90% from 3.0% due to a drop on the forecast for third-quarter real consumer spending growth ticked down by 0.10%.The NY Fed’s Nowcast forecasts took a big hit. Both Q3 and Q4 declined by 1/2% to 2.30% and 1.20%, respectively. The largest negative contributions came from manufacturing, retail sales, and housing and construction data.

Initial claims for unemployment fell by 8k to 252k. It was one of the lowest numbers since 1973 and indicates a tightening labor market.

EARNINGS RECESSION CONTINUES

According to FactSet, earnings will decline for the sixth straight quarter, the longest streak since 2008. The losing streak was expected to end this quarter but that likely won’t happen. Analysts now expect earnings to finally improve in Q4.

FISCAL STIMULAS WORLDWIDE

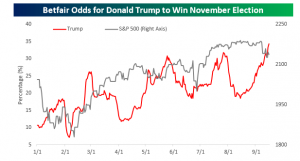

There seems to be a worldwide movement beginning to utilize fiscal stimulus to get economies moving. Canadian Prime Minister Justin Trudeau has a $46b 10-year infrastructure plan. Japan has a $45b plan. There is similar talk elsewhere around the world and both Clinton and Trump favor new fiscal stimulus. The consequences are unknown, but someone will have to pay or finance this spending. In the US, higher inflation and a lower dollar might result, but the plan could put an end the earnings recession cited above.