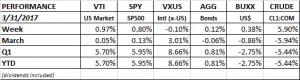

PERFORMANCE

The quarter ended on a positive note as US equities advanced by almost 1% for the week. For the quarter, US equities were up 5.7% and international (x-US) equities advanced 8.66%. The bond aggregate was up 0.81%. The dollar actually declined for the quarter by 2.75% as did crude, -5.44%, although it moved higher on the week by almost 6%.

While the consensus was for value to be the place to invest in 2017, so far it has been large cap growth, especially technology, which dominated the first quarter. The QQQ was up 12%.

TECHNICALS

It might be nothing or it might be the start of a sell-off. The market is overdue for a correction of 5 to 10%. On Monday, the market was off 2.27% from its March 1 peak but had a small rally since. If the market turns down over the next few days, that would be two successive “lower highs”.

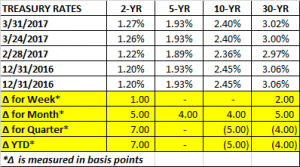

TREASURY RATES

Treasury rates were flat for the week. For March, rates rose about five basis points across the curve and year to date, there has been a slight flattening, with the 2-year note up seven basis points and the 10 and 30-year down about five.

TRADE

The Trump administration indicated it will seek only modest changes to NAFTA. A major push to cut back on international trade via protectionism would be a negative for growth in the US and around the world. A more modest approach to trade was what the market had anticipated when this rally began in November, and that might turn out to be the case. Although the threat of more aggressive action could still happen as the administration irons out its policies.

CONFIDENCE SURGES

The Conference Board’s Consumer Confidence Index surged to the highest level since December of 2000. A high level of confidence has traditionally been associated with better than average growth.

BREXIT

On Wednesday, the UK made it official by triggering Article 50 and letting the EU know that it will be leaving. This begins a two-year period for the UK to negotiate its exit.

MARGIN DEBT

Margin debt hit a record in February. More than $500 billion is currently borrowed against accounts. High levels of margin debt indicate investor confidence but is often a contrary indicator that reveals that investors are ignoring fundamentals and concentrating on making a quick dollar. Margin debt peaked before declines in 2000 and 2008. But margin debt as hit record levels several times previously during this bull run with no negative impact.

ECONOMY

2016 Q4 real GDP was revised up to 2.1% from 1.9%. Year over year, GDP was up 2% for 2016 compared to a 3.1% average historical gain.

The GDPNow model forecasted growth for Q1 dropped to 0.9% on declines in estimates for consumer spending growth. The NY Fed’s Nowcast dropped by 0.1% to 2.9% for Q1 and to 2.6% for Q2.

Initial claims for unemployment came in at 258,000.