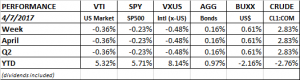

PERFORMANCE

US equities fell slightly, down 0.36%, but that was a good performance given the market was hit with a batch of negative news. On Wednesday, North Korea launched another test missile, on Thursday, the US fired 59 Tomahawk missiles into Syria in response to deadly chemical attacks against its own citizens, and on Friday, in another example of our dysfunctional government, the Republicans eliminated the filibuster rule for Supreme Court nominations. Then there was the payroll report that came in much less than consensus. This market continues to show good resilience in not falling in the face of negative news. But while the market has not been falling, it has also been having a hard time going higher. There were only 72 NYSE stocks at new highs this week, compared to 338 on March 1.

International stocks were down 0.48%, bonds were up slightly, the dollar was up by 0.61% and crude, helped by the missile strikes, advanced 2.83%.

EMPLOYMENT

Non-farm payrolls increased by 98,000, well below the consensus estimate of 175,000 and down from a revised 219,000 in February. Weather might have been a factor as the northeast suffered from a major blizzard. There might be a seasonal factor at work, the March report has missed consensus number in five of the last six years. The unemployment rate dropped to 4.5% from 4.7%. Average hourly earnings were up by 2.7%

Initial claims for unemployment dropped by 25,000 to 234,000. Claims as a share of the labor force hit a record low in February. Even with the lower hiring number, the labor market continues to be tight.

FED

The Federal Open Market Committee’s March minutes show that the Fed may begin to work down its $4 trillion balance sheet later in the year. This would be accomplished by reinvesting less as issues mature. As of now, the Fed has been reinvesting the proceeds from all maturing issues. The aim would be to accomplish this in a “passive and predictable” manner. However, this would put upward pressure on interest rates.

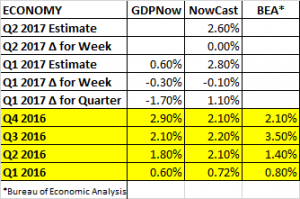

GDP

The Atlanta Fed’s GDPNow continues to sink, estimating growth at 0.60% for Q1, that is down from 0.90% last week and from 2.30% at the beginning of the quarter. The GDPNow estimate continues to diverge from the NY Fed’s Nowcast, which is forecasting more solid growth at 2.80% for the first quarter and 2.60% for the second quarter.