MARKET RECAP

- The overall US markets fell by 0.45%, but the S&P 500 was somewhat flat, down by 0.16%, the NASDAQ was down by 1.28%. International stocks fell by 2.27% and bonds were off by 1.09%. The yield on the 10-year rose by 23 basis points to 3.12%.

- The NASQAQ (see below) is down 24% from its November 19th high, and the S&P 500 is down 14% from its January 3rd high. Watch CNBC, read Barron’s, etc, the consensus is that there is more downside to come. That, of course, doesn’t necessarily mean that will happen, if anything, it could be a contrary indicator that we are getting closer to the bottom. Time will tell.

- With equity prices down, and interest rates up, CurrentMarketValuation.com runs an analysis of various valuation models, taking a long-term view, and in terms of the S&P 500 versus the 10-year, they rate the S&P as fairly valued. While the S&P is 1.3 standard deviations above its trendline, interest rates are 1 standard deviation below, netting out at a fair valuation. That trade-off could change though, if interest rates continue to advance and/or earnings decline.

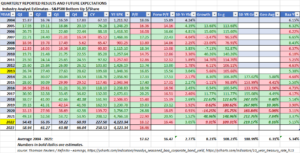

- A look at the chart below, which shows the p/e of the S&P 500 as well as the 10-year, comparing to 2013 as an example, the 10-year was 3.04% compared to 3.05% today, and the p/e was 16.85 versus 18.12 today. That would imply another 7% on the downside assuming interest rates and earnings projections remained the same. But that is just one data point.

- The Fed raised rates by 0.5% and said they would sell down the balance sheet by $45 billion per month to start and then by $90 billion per month starting in a few months.

- Former Treasury Secretary Larry Summers, in a WSJ interview, said there are substantial economic risks to the economy at this point and that a combination of high inflation and low unemployment has historically led to a recession within two years.

- The labor market remains strong with 428,000 new jobs added in April making it 12 straight months of 400,000 plus gains. The unemployment rate stayed steady at 3.6%. Wage growth came in a 5.5% just off from 5.6% the previous month and less than the 8.5% increase in consumer prices in March compared to the previous year. The negative news was a decline in the work force by 363,000, the first decline since September and there was no clear explanation as to why. Total employment is still off by 1.2 million jobs compared to pre-pandemic numbers.

- Productivity fell by 7.5%, the worst number in 75 years.

SCOREBOARD