MARKET RECAP

Stocks went up, what else is new, by 2.37% in the US and 4.36% outside the US. But that was not the big news this week, not close. In one of the saddest displays in US history, a Trump-inspired mob invaded/attacked the halls of Congress while the Senate was conducting its ceremonial duties of making the electoral college vote official. The proud US tradition of a peaceful turnover of power was briefly interrupted, and if Trump’s previous actions did not warrant it, his reputation will certainly be ruined forever by this act and deservedly so. We wrote back on September 25th that Trump would not commit to a peaceful transfer of power and that this was “another reason why he is unfit to be President.” He definitely deserves to be removed from office via the 25th amendment or impeached, although this is unlikely to happen with just days remaining in his term.

Trump’s actions earlier in the week probably cost the Republicans the US Senate. The two Georgia Senate seats went to the Democrats by narrow margins. Earlier in the week Trump was recorded asking Georgia officials to find another 11,000 votes so that he could suddenly and retroactively win Georgia. The Georgia officials would have none of it and made it clear it was a fair vote, both the Presidential contest and the Senate runoffs. However, Trump trying to fix the election, the very thing he has falsely accused the Democrats of, probably cost the Republicans the necessary margin to win one or both seats.

So now the Senate is 50-50, with Kamela Harris giving the Democrats the edge. Hopefully, the small 51-50 advantage will be enough to keep Biden’s policies more towards the center-left than the extreme left. Biden has already indicated he is going to go for lots of fiscal stimulus, thereby throwing the country deeper into debt. As they say, a trillion here, a trillion there, and soon you are talking about real money!

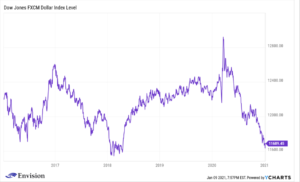

Well, real money it is, although the value of that real money is declining at a fast clip. The dollar is down 9.53% since March.

In fact, there is so much money around, that the market just goes up every day no matter what happens. When it looks like the Republicans will win the Senate, the market is up. Nope, the Democrats won, ok, that is a reason for the market to go up. Employments numbers go up, we get a higher market. Employment numbers down, which means more stimulus, the market goes up. A violent mob overtakes the Capital, no problem, stocks just continue to rise. If this isn’t stock market euphoria then what is? It just feels like the market will go up every day, which of course, is often when the market is most dangerous. But practically speaking, this can go on for much longer or it can end tomorrow, but every day the market rises futures returns are declining.

The stimulus that was just passed has not even fully been distributed yet. Applications for the PPP portion are not even available yet. And then you will have a second tidal wave of money with Biden’s new fiscal stimulus. So if the past is an indication of the future, equities will have plenty of fuel behind them.

Somewhat of an offset to an even higher stock market could be rising interest rates, higher taxes especially in the corporate sector, increased regulation, and the economy itself. When corporate tax rates were cut at the beginning of the Trump turn, stocks rallied as suddenly every dollar of revenue generated was suddenly worth a substantial amount more. And while Biden probably won’t increase taxes on corporations all the way back, whatever he does increase is coming right off the bottom line. That immediately raises p/e ratios unless prices adjust down. And then deregulation over the last few years has had a substantial impact on improving the fortunes of business. That now goes into reverse. And finally, the economy is slowing. The US lost 140,000 jobs in December, the first decline since April.

International markets seem to be overtaking the US recently in terms of equity performance. In the chart below, which compares the overall US stock market (VTI) versus outside the US (VXUS) when the solid black line is rising, the US is outperforming, and when falling, international is performing better. Over the last few months, the US seems to have topped in terms of relative strength and in recent weeks international stocks have outperformed. This might be reversing years of US outperformance.

Interest rates rose sharply during the week as the Democrats swept Georgia. The yield on the 10-year was up by 20 basis points.

SCOREBOARD