MARKET RECAP

You can make a good case that the only good thing in 2020 was the stock market, that, and the triumph in science in quickly creating a vaccine. In a year marked by a global pandemic, a literal stop to the entire US economy, stocks turned in an amazing performance. The S&P 500 was up by 18.33% for the year. International stocks advanced by 10.67%. Massive government intervention, on a scale never seen before and in dollars never imagined, including dropping interest rates to nothing, powered equities here in the US and worldwide.

A lot of the gains in the index were powered by the technology leaders like Apple (+82%), Amazon (+76%), and Netflix (+67%). When looking at the S&P 500 and calculating on an equal-weight basis, the market was up by 12%, still very impressive.

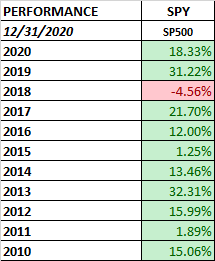

US stocks have now been up ten times in the last eleven years and have put in double-digit gains two years in a row.

Needless to say, on an absolute basis, ignoring low-interest rates which might provide justification, valuations are high. The hoped-for and long-anticipated recovery is going to have to shift into high gear to catch up to current valuations.

Looking forward at 2021 earnings estimates, stocks sell at a price-earnings ratio of 22.46. That is high. The median stock in the Morningstar coverage universe now sells at 109% of fair value, which is the second-highest amount going back to 2007. But as we said above, with interest rates at incredibly low rates, there is some justification for elevated valuations based on traditional metrics.

There are signs of euphoria in the market. IPOs that soar to ridiculous heights (DASH and ABNB), Tesla up by 743%, Bitcoin is at $31,882, up by 354% since August. SPACs (special purpose acquisition companies) or blank-check companies proliferated in 2020, there were 248 that went public last year. Here you have investors buying in on the hope that the SPAC can find something worthwhile to purchase. You are not buying an income-producing or revenue earning business, just a hope that your SPAC can find one.

As far as the economy, the US continues on the rebound path but has slowed of late due to the surging virus. Vaccines by Moderna and Pfizer are slowly being rolled out, and everyone in the US should be able to receive a vaccine by September if they want one. With or without the vaccine, the growth of the virus should begin to taper down within a few months, at least based on past pandemics.

Retail sales were up by 2.4% between November 1 and December 24 compared to the same period a year prior. Online sales soared by 47.2%. The National Retail Federation had been expecting an increase of at least 3.6%. There were winners and losers. Department store sales fell by 10.2% while furniture was up by 16.2% and home improvement by 14.1%.

Between trade issues with China, and Covid, companies have been evaluating their supply chains. Some businesses are considering bringing factories closer to home, others spreading out factories around the world so they don’t have to rely on just one facility. In either case, the net result is going to be less efficient supply-chains, which would be a contributing factor to higher inflation down the road.

High inflation down the road, from a declining dollar, from the government dropping money everywhere, from less efficient businesses, wherever it might come from, represents a threat. That would mean higher interest rates in a world where the US deficit has simply grown way out of control. Or, if the Fed suppresses interest rates, the possibility of runaway inflation and a plunging dollar. Counterbalancing higher inflation is a population that is getting older, that will save more than it spends, and improved productivity from better technology.

In the meantime, the market continues to move higher. That can change on a dime, but momentum is currently positive.

SCOREBOARD