HIGHLIGHTS

- Markets fall in the US by 0.76% and 1.44% around the world.

- “Second-order” effects from the trade war likely to be more damaging than the actual tariffs.

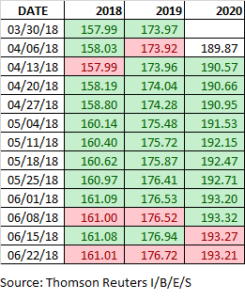

- Earnings estimates for 2018, 2019 and 2020 fall across the board for the first time this quarter.

- Consumers will soon start to feel the pain.

- The Fed unwind to ramp up next quarter by $30 billion.

MARKET RECAP

The last few weeks, the market has been essentially ignoring the trade war talks. But that started to change this week. On Tuesday, Trump announced that he wanted to add another $200 billion on Chinese imports and hinted at more tariffs on European autos. That was enough to get investors to realize that maybe something not so good is going on here. US stocks fell by 0.76% for the week and international markets dropped by 1.44%. The Dow fell 2% and has been down in 8 of the last 9 sessions.

Nancy Lazar, from Cornerstone Macro, comments in this week’s Barron’s, that second-order effects could be more significant to the economy than the actual tariffs. “Second-order effects, more difficult to quantify, would include a hit to business confidence, headwinds from a stronger dollar, and supply-chain disruptions, including a loss of competitiveness of U.S. exporters who rely on imported components.”

All of this seems to be seeping into earnings estimates. For the first time this quarter, estimates from Thomson Reuters for the SP500 for 2018, 2019 and 2020 fell across the board (see the table below). The threat is that Trump may be overplaying his hand and creating self-induced pain across economies here and around the world.

The higher tariffs will wipe out a portion of the benefits of tax cuts, so what the US can end up with is slower economic growth than would be otherwise, with much higher deficits. Not the ideal combination.

The hope would be that somehow all of this leads to a world of lower tariffs across the board and more free trade, which would be a boost to global economies.

CONSUMERS AND FARMERS

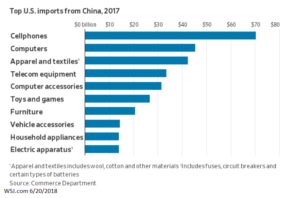

US consumers have been immune from the trade war so far, but that will soon start to change. Trump’s new proposal to put tariffs on $200 billion in Chinese imports will hit a wide range of retail products. The original set of tariffs on Chinese imports impacts businesses, but the latest round will cost retailers or their customers.

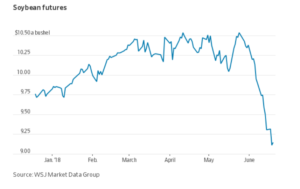

Farmers are also feeling the pain. Chinese tariffs on agriculture are putting downward pressure on crop prices. Soybeans fell to their lowest prices in two years. Grain and livestock are also down in price.

FED UNWIND

The Fed unwinding of its balance sheet is going to increase, from $90 billion in the current quarter to $120 billion next quarter. That means another $30 billion out of the financial system.

SCOREBOARD