HIGHLIGHTS

- US stocks were up 0.17% while international equities fell by 1.09%.

- The US economy is moving forward while international economies are improving at a slower rate.

- The Fed increased rates by .0.25% and is projecting four increases this year.

- The ECB will end its bond-buying program in December.

- The trade war heats up.

MARKET RECAP

US markets increased by 0.17% while international equities dropped by 1.09%. Investors have simply ignored all of the trade war tariffs (see below), under the theory that it is just rhetoric that eventually will be settled. Bonds were up by 0.12% and the dollar advanced by 1.37%. Trump met with North Korean dictator Kim Jong-un. There was no official agreement but a promise by North Korea to “denuclearize.”

GLOBAL SPLIT

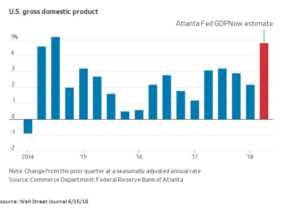

Last year the key economic words were “global synchronization”, as in growth around the world. But now, the signs of a split are becoming more clear. The US, powered by deregulation, tax cuts, and low unemployment, is picking up steam, while growth rates around the world are beginning to slow. Retail sales increased by the most in six months in May. The Atlanta Fed’s GDPNow model now is forecasting Q2 growth of 4.8%, which would be the most in almost four years. But this might be as good as it gets, the IMF sees US growth slowing in future years.

Meanwhile, the Euro is losing ground against the dollar. On Thursday, the Euro dropped by the most since the Brexit vote. Germany reported that factory orders dropped 2.5% in April, and eurozone growth came in at 0.4% in Q1, down from 0.7% in Q4 of 2017. Economists are not quite ready to write off Europe, many believe this is a temporary stall and that growth will resume.

FED/ECB/BOJ

The Fed increased rates by 25 basis points to a target range on the fed funds rate between 1.75% and 2.00%. That move was already baked in the cards and was not a surprise. The more significant news was that the Fed pulled forward its timeline on projected rate increases in the future. It is now more likely that we get four rate hikes this year, three in 2019 and one in 2020. Previously, it was three for this year, three in 2019 and two in 2020. So one hike was added this year and one was taken away in 2020.

The ECB announced they would end their bond-buying program in December. But the Bank also said they would wait at least until the summer of 2019 before raising the deposit rate, currently at -0.4%.

The Bank of Japan kept its short-term interest rate at -0.1%.

TRADE WAR RISK

The market has basically been ignoring the risk of a trade war, even though the rhetoric that is being tossed around is like nothing ever seen in recent times. Trump went after Canadian Prime Minister Justin Trudeau via Twitter. Canada has announced tariffs of almost $13 billion on US products. Mexico has added tariffs of $3 billion, and the EU is looking at about $7.5 billion. While these numbers, in percentage terms, are small, they will all negatively impact the value chain, and begin to hurt businesses at the margin. Trump should take the high road, and the smart road, and propose the worldwide elimination of all tariffs, with no restrictions on trade anywhere (other than for legitimate security reasons).

SCOREBOARD