HIGHLIGHTS

- US stocks were down by 0.26% and international stocks fell by 1.01%.

- Bonds dropped by 0.53% as the 10-year yield hits a 7-year high.

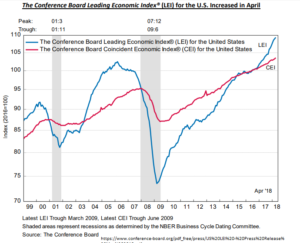

- The Leading Economic Index improves.

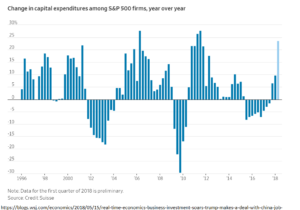

- Capex soars in Q1.

- NAFTA talks appear stalled.

MARKET RECAP

Stocks in the US fell by 0.26% and by 1.01% outside the US. Higher interest rates worried the markets as the 10-year yields hit a 7-year high, causing the bond market to drop by 0.53%. Increased yields reduce the present value of a future stream of cash flows, resulting in a theoretically lower stock market value, all other things considered. But the offset to that are the “other things”, such as a decent economy, improving earnings, buybacks, etc. Small caps, for one, don’t seem concerned, the Russell 2000 Index hit new highs this past week.

But trade continues to be a worry. Slight progress was reported on talks with China, but that has yet to be resolved. At the same time, NAFTA negotiations missed an important deadline and appear to be stalled.

LEADING ECONOMIC INDEX

The Conference Board’s Leading Economic Index was up by 0.4% in April, March was also revised up to 0.4% from 0.3%. Eight of ten components made positive contributions. “April’s increase and continued uptrend in the U.S. LEI suggest solid growth should continue in the second half of 2018. However, the LEI’s six-month growth rate has recently moderated, suggesting growth is unlikely to accelerate,” said Ataman Ozyildirim, Director of Business Cycles and Growth Research at The Conference Board.

As shown in the chart below, the LEI, which represents future growth. is increasing faster than the Coincident Index (CEI), which represents current growth, a positive sign.

10-YEAR YIELDS

The yield on the 10-year Treasury note hit its highest level in seven years on Tuesday in response to positive economic news. Consumer spending was up in April for the second straight month and a NY Fed manufacturing survey had better than expected results. The higher yields are carrying over to mortgage rates. The average rate for a 30-year fixed rate mortgage rose to 4.61% from 3.99% in January and 3.31% at its low in 2012. Higher mortgage rates might encourage homeowners to stay in their current homes instead of trading up. Higher rates will also make some homes less affordable for prospective buyers.

CAPEX SOARS

Helped by tax cuts, deregulation, and repatriation, investment in capital (capex) such as factories and equipment were up 24% to $166 billion in the first quarter, after an extended period of subpar investments. Although capex is considered good for long-term economic growth, studies suggest that shares of companies with large capital investments underperform the market. However, there are always exceptions, Amazon being perhaps the best example.

NAFTA

Trade negotiators missed a deadline to wrap up a North American Free Trade Agreement deal this week. Despite President Trump’s claims, NAFTA has been a big boost to economic growth in North America and failing to renew the agreement would be an economic negative.

SCOREBOARD