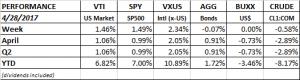

PERFORMANCE

The US equity markets turned in another solid week, gaining about 1.5%. International markets did even better, +2.34%. Bonds fell slightly, the dollar was even and crude was off boy 0.6%.

Very strong earnings are moving the markets higher. According to FactSet, as of Friday, the blended earnings growth rate is 12.5%, above the 9% estimate at the beginning of earnings season. This would be the first time since Q4 of 2011 when the SP500 companies reported a double digit earnings increase.

The market is still trading in a range of between 2280 and 2400, and it will have to crack the 2400 line (orange line above) to possibly begin another leg up.

TAX PLAN

Trump proposed an outline for an aggressive tax plan. He is leaving it up to Congress to fill in most of the details. The plan would cut tax rates on corporations from 35% to 15%. There would be a one-time “amnesty” rate of 10% to encourage repatriation of about $2 trillion in profits that US companies have been keeping overseas. The proposal to get those dollars back into the US is a good idea and both parties should support that. The plan also taxes only domestic profits, another smart proposal.

The tax cut would also apply to “pass-through” entities like Sub-S corporations. That would give the pass-through entities a big tax advantage over regular corporations since income on corporate profits is eventually taxed two times, while a pass-through is taxed one time.

A corporation is taxed on its income, and then its shareholders are taxed at some future point on dividends and taxable gains. The tax proposal calls for a 15% corporate tax and a 20% dividend/capital gains tax. For $100 of income, the corporation will pay $15 in tax. That would leave $85 in the business. Let’s assume that $85 is paid out as a dividend, it will get taxed on the personal level at 20%, resulting in another $17 in tax for a net of $68. Meanwhile, the same pass-through entity investor would net $85.

One of the main ideas of reforming the tax system is making it equitable and easy to understand. The pass-through advantage does not do that. That needs to be corrected.

The other huge issue is that the plan would result in trillions in lost revenue. Of course, the argument is that the economy would grow faster, and that would eventually result in most of the lost revenue being recovered. The proposed cuts are too deep and too risky given the country’s fiscal situation.

In sum, the plan won’t pass as proposed but it is a starting point.

GDP

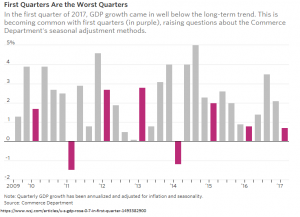

The Commerce Department reported that GDP growth in Q1 was 0.70%, the lowest reading in three years, and not a good start to the Trump era. This is the initial reading and it will be revised down the line, but it continues the string of weak Q1 growth that we have seen over the past several years.

Trump has promised to get growth to 3% plus. That is a tall order. But Q2 growth is expected to improve. The NY Fed’s NowCast currently has Q2 growth estimated at 2.3%, plus 0.20% on the week on positive news on manufacturing and housing data.

On a positive note, wages grew at the fastest rate since Q1 of 2007.

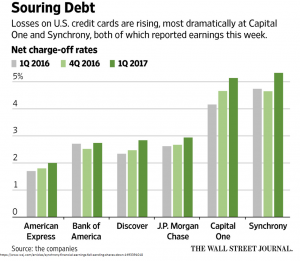

CONSUMER DEBT

We spoke about this at our quarterly webinar (click to view), trends in consumer debt are turning negative. Credit card lenders are reporting more losses. This is probably the result of leaner credit standards and overspending by consumers. The subprime market is where the hits are being taken and the threat is if there is a spillover effect.

NORTH KOREA

The market has been ignoring North Korea but the heat is rising. Secretary of State Rex Tillerson addressed the U.N. on the need to step up pressure on North Korea. A U.S. nuclear submarine has arrived at a South Korean port. On Saturday, North Korea launched conducted another missile test. Like the one prior, it failed. Trump would not rule out the use of military force in an interview on “Face the Nation” on Saturday.

GOLD

One investment that might benefit from a major geopolitical event like North Korea would be gold. The Gold Miners ETF (GDX) is off 8.2% from its recent peak in mid-April.