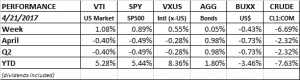

PERFORMANCE

The US equity markets advanced by about 1%, and in the process, at least for now, broke the recent downtrend. International equities were up 0.55%, bonds were about even, the dollar declined and crude fell by 6.7%.

This week will start on a positive note as France’s pro-growth candidate Emmanuel Macron finished first in the Sunday election and advances to the runoff with nationalist Marine Le Pen. Macron is favored and a win will keep the Eurozone intact.

The market has been advancing in a stair step fashion. It trades in a sideways manner, breaks out, then enters another consolidation phase, and then breaks higher again. That might be continuing.

Earnings appear to be on target for an approximate year over year increase of about 11%. Excluding energy, about 7.5%. Improving earnings will work down some of the excess valuation in the traditional ratios like price to earnings, price to sales and price to book.

GOVERNMENT FUNDING

Trump just complicated the process of keeping the government operating. The government runs out of money on Saturday and a deal must be passed to keep the US in business. Trump is now demanding that the legislation include funds for a border wall with Mexico. That is a deal-breaker with the Democrats and will make it more difficult to avoid a government shutdown next weekend.

ECONOMY

Initial jobless claims came in at 244k, a low number. Existing home sales were up 5.7% year over year. Industrial production rose by 1/2% month over month. The flash PMI composite estimate fell to 52.7 from 53.2 That is down but still above 50, indicating growth.

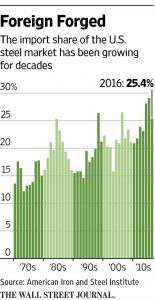

STEEL IMPORTS

The Trump administration announced that it is opening up a probe into steel imports, indicating that national security might require a cut in imports. The trade law cited to justify the cut in imports requires a study that will be submitted to the Commerce Department that assesses the legitimacy of the national-security claim.

It is one thing to retaliate against a company that is “dumping” product with the help of government subsidies, it is another to implement across the board cuts that impacts even those that compete fairly. Such an across the board cut would possibly result in retaliation against other US manufacturers.

Cutting imports would allow US manufacturers to increase steel prices even further. Manufacturers ramped up prices last year after the government imposed duties on imports from some companies in China and elsewhere. US steel prices are already among the most expensive in the world and impact a wide range of businesses that are the consumers of steel. There are about 60 workers in steel using industries for every steelworker in the US. A mismatch which shows that such an across the board cut might not past a true cost/benefit test.

TAX PLAN

Trump officials plan to release a tax overhaul plan soon. The plan would concentrate on business first (corporate and pass-through entities) and leave individual tax reform for after.