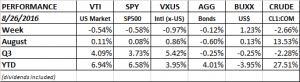

PERFORMANCE

Equity markets fell last week. US markets were down by about 0.55%, international by about 1%, bonds fell slightly (0.12%) and crude dropped 2.66%. The USD was up by 1.23% on the chance for higher interest rates earlier than expected. That has helped financials which have been a strong performer of late.

A prolonged period of low volatility, a negative divergence of price performance versus technical indicators (see pink graphics below), price action that is slowing rolling over, and a calendar period (August to October) that sometimes, historically, has been unkind to stocks, might be a hint that there is the possibility of a small to modest sell off here.

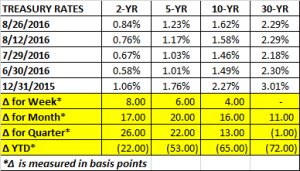

Interest rates rose 8 basis points on the 2-year note, 6 on the 5-year, 4 on the 10-year and 0 on the 30-year, as the curve flattened. Hawkish comments by Fed vice chair Stanley Fischer indicated that a rate hike is possible in September or December.

Economy

The GDP estimate for Q2 was revised lower to 1.1% from the 1.2% advance estimate. That works out to real GDP growth of 1% in 1H, the slowest pace in three years. However, the Q3 estimates are tracking much higher.

The Atlanta Fed’s GDPNow forecasts Q3 growth at 3.4%, down from 3.6% last week. A decline in the forecast for Q3 real residential growth pushed the estimate down. The NY Fed’s Nowcast also declined by 20 basis points. Positive news from higher than expected new single family home sales was offset by higher than expected manufacturers’ inventories of durable goods (indicating subdued demand).

Jobless claims remain low, coming in at 261k last week, down by 1k.

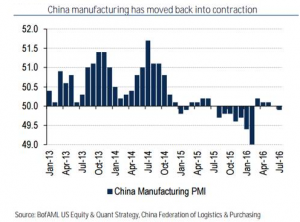

China’s manufacturing PMI moved back into negative territory, although just barely. China is a wildcard that moved the market down significantly at the beginning of the year.