A quick report as I was traveling all last week.

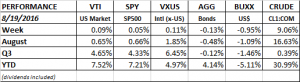

PERFORMANCE

With the exception of oil, it was a quiet week all around. All of the equity markets were up about 0.10%, the bond index was down by 0.13%. The US dollar declined by 0.95%. Crude had a big jump, +9.06%.

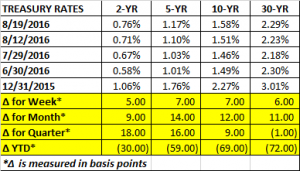

Treasury rates were slightly higher, up by between 5 to 7 basis points all along the curve.

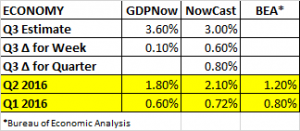

ECONOMY

Jobless claims dropped by 4k to 262k. Claims have been consistent around the 265k area. These numbers are ridiculously low. This makes 76 straight weeks of sub 300k claims, the longest such streak since 1970 when the US population was 2/3’s the size of what it is now.

The Fed released their July minutes, leaving open September for a possible increase. The officials seem to have mixed opinions and the next increase will likely be in December. That would be after the election and still give the Fed the opportunity for at least one increase in 2016.

GDP estimates for Q3 improved. GDPNow is forecasting 3.60% growth (up by 0.10%) and the NowCast increased by 0.6% to a 3.0% estimate. Q3 is looking, at least so far, to be a much better quarter than Q1 and Q2.

TRADE

Last week we wrote about free trade and how the two Presidential candidates are politicizing trade to win an election, not to improve an economy. Barron’s has followed up with their cover story titled “Free Trade, Why it’s Good for America.”

The link to the article is here.