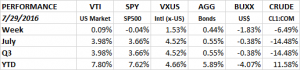

PERFORMANCE

The US equity markets were flat, but international markets advanced by 1.53% and the bond index managed a 0.44% gain. The US dollar dropped by 1.83% and crude took another hit and fell by 6.49%. July overall turned out to be a great month. The US markets were up almost 4%, international about 4.50% and bonds +0.55%.

The SPY (SP500) ETF has traded in a tight range between $215.31 on the downside and $217.54 on the upside. That spread represents just 1.02% of the closing price on Friday. The Volatility Index (VIX) closed at 11.87, a ridiculously low number based on history.

We are now start August, which has been the worst month of the year over the last 20 years. The Dow has averaged a decline of 1.30% during that time period.

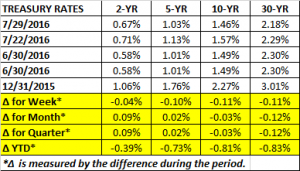

Treasury rates fell by about 10 basis points from the 5-year bond on out in reaction to the lower GDP number (see below).

ECONOMICS

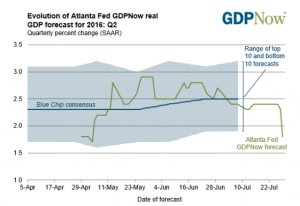

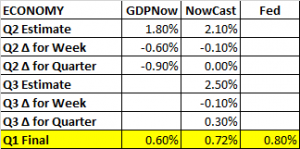

In a shocking report, GDP grew 1.22% in Q2. That was way off the GDPNow estimate which was 2.4% last week and the NY Fed’s Nowcast which had growth estimated at 2.2%. GDPNow was revised lower earlier in the week to 1.8% but it was a miss that was simply unexpected. The consensus was for a 2.6% advance.

Of course, GDP might end up being revised higher (or lower) as more data comes in, but growth of 1.22% is a big disappointment. The number was hurt by a significant fall in inventories. The good news is that when businesses rebuild their inventory levels, that will provide a boost to GDP down the line. On the positive side, consumption increased by 2.8% for the quarter, the highest growth rate since 2014.

The GDP report must have even surprised the Fed, which earlier in the week indicated that an interest rate hike is back on the table. The Fed stated that “near-term risks to the economic outlook have diminished.”

Of late, economic reports have been coming in better than expected as evidenced by the Citibank Surprise Index that we posted a couple weeks back (click here). But with the lower GDP number, with the possible slowdown from Brexit, geopolitical problems and the US Presidential election, economic risk to the downside is increasing.

Jobless claims rose to 266k, up 14k from last week. But 266k is a very low number, the labor market continues to be tight.

For Q3, the NY Fed Nowcast dropped only 10 basis points, showing respectable growth of 2.50%.