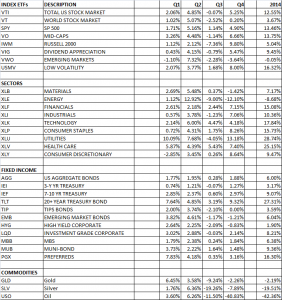

Below is our 2014 Scoreboard which highlights returns (dividends included) of market index ETFs, sectors, fixed income and a few commodities.

The USA Minimum Volatility (USMV) fund led the way with a 16.32% return followed by the Vanguard MidCaps (VO). The SPY was up 13.46% and the VTI advanced 12.55%. The Vanguard Emerging Markets (VWO) fell just under break even at -0.05%.

In terms of sectors, Utilities (XLU) was the big winner at plus 28.74% with Healthcare (XLV) just behind at 25.15%. No surprise that Energy (XLE) lost 8.68%.

The TLT had a staggering 27.31% advance in the fixed income space, Preferreds (PGX) also moved ahead nicely at 16.30%. High yield had the lowest return at 1.90%.