MARKET RECAP

Stocks were down this week, by 0.87% in the US and 0.73% outside the US. The bond index rallied by 0.51%, interest rates fell by 35 basis points on the 10-year.

Producer prices were up by 8% compared to last year, which was lower than 8.4% in September and 11.7% at the March peak.

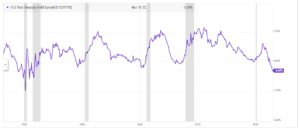

The spread between the 10-year and the 2-year treasury has reached its highest point since the early 80s at 69 basis points. Such a differential was a precursor to recessions in the past. Meanwhile, Q4 looks on track for solid growth. The Atlanta Fed’s GDPNow model has Q4 growth at 4.2%. There was also a strong retail sales report, up 1.3% in October, the best gain since February and higher than the 1% consensus.

The incredible FTX saga continues. It turns out the financials are a complete mess. John Ray, who took over as CEO and is a restructuring expert, said “never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information.”

There appears to be $900 million in marketable assets against $9 billion of liabilities just before the bankruptcy filing. There were minor cryptocurrencies held on the balance sheet for big amounts that had negligible value. Supposedly Serum was recorded at $2.2 billion but is worth less than $100 million if even that. Furthermore, Serum was a token that FTX created (read Matt Levine’s article at Bloomberg for much more).

SCOREBOARD