MARKET RECAP

- A late Friday comeback saved the S&P 500 from closing 20% below its January high. The index is down 18.7% from its January 3rd high. The Nasdaq is down by 28.2%. For the week, the overall US market fell by 2.78%, but international stocks managed a 1.35% rally. Bonds were up by 0.63% as the 10-year treasury yield fell by 15 basis points to 2.78%.

- The Dow closed lower for the 8th week in a row, the last time that happened was in the Great Depression. The S&P 500 and the NASDAQ are down seven straight weeks, the longest streak since 2001. The main fear driving prices lower is now the threat of a recession as opposed to higher interest rates.

- A recession is on the way according to more and more executives and government officials. Wells Fargo CEO Charlie Scharf said “It’s going to be hard to avoid some kind of recession. Former Fed Chair Ben Bernanke said “Even under the benign scenario, we should have a slowing economy.” Everyone is in agreement that two things are certain in the near and intermediate term – higher prices and higher unemployment – stagflation.

- The fear of a recession is also starting to get priced into bond markets. The yield on the 10-year treasury peaked two weeks ago and has fallen as fears of a recession are starting to rise. Even some booming commodities are falling in price, nickel is down by 42% and copper is down by 13% since the March highs. Both metals benefit from a strong economy.

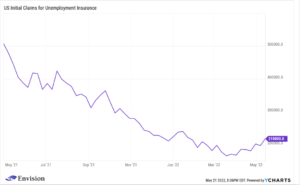

- Don’t look now but initial claims for unemployment insurance, while still at historically low levels, has started to turn up in recent weeks.

SCOREBOARD